If a borrower purchased the subject property for cash within the last 12 months, refer to the guidelines below for Loan-to-Value/LTV Determination for Property Owned Less Than One Year and Recoup of Funds Used for the Recent Purchase of the Subject Property. If a borrower was added to title or received the property as a […]

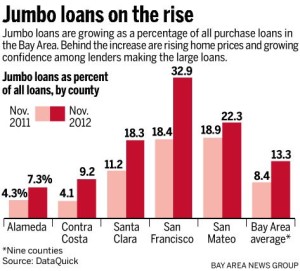

Jumbo Loan Requirements for Cashout to 80% LTV: Recoup of Funds Used for the Recent Purchase of the Subject Property

Open Houses in Pleasant Hill This Sunday

If you are looking to purchase Real Estate in Pleasant Hill and you would like to see what homes are going to be open on Sunday —————————————————— HERE IS A LIST OF OPEN HOMES IN PLEASANT HILL COMING UP —————————————————— Click the link above to check out upcoming open homes scheduled in Pleasant Hill […]

Walnut Creek Jumbo Loans: What is the Lowest Rate Today and What Exactly is a Jumbo Loan?

Jumbo mortgage loans for Walnut Creek CA homes can be hard to get approved for if you aren’t working with a Loan Officer or Mortgage Broker that knows exactly how to structure your loan. Most consumers applying for these large Jumbo Loans in the Walnut Creek area have complicated tax returns with K-1s and many […]

Using Assets as Income to Qualify For a California Mortgage Loan

Asset based lending in CA Bay Area Cities like Walnut Creek, Lafayette, Orinda and Pleasant Hill is alive and well. Did you know that if you have a large amount for liquid assets in a mutual fund or stock account, but you are having trouble documenting income as defined by the IRS on your […]

Getting a Jumbo Loan in California Above $700,000 – High Balance Loans up to 5 Million – 10 Reasons to Apply With Us!

Posted by Jason Wheeler | Fully Follow Me | Read More Investor relationships are key when you are referring to getting a loan. Especially if you are applying for a Jumbo Loan amount above $700,000. In today’s volatile lending environment it has become more and more difficult to secure financing especially for large loans and […]