Looking for a Bay Area Mortgage Pre Approval? The home loan process in the Bay Area can be full of challenges and “turbulence” sometimes. Rest assured the challenges are 100% worth it in order to become a home owner. If you want to cut to the chase and get your pre approval just go here. […]

Fast Bay Area Mortgage Loan Pre Approval

It’s so easy to get a mortgage pre-approval letter. It should only take about 15 minutes on the phone with a good Loan Officer and just a bit of work gathering a few income documents. We specialize in getting you pre approved fast in cities like Pleasant Hill, Walnut Creek, Concord, Martinez and Lafayette, or […]

Bay Area Jumbo Loans Approved When Other Lenders Say No – Plegded Assets and Asset Depletion Are Okay!

C2 Financial and Jason Wheeler have some unique products that will help you get a jumbo loan closed. If you have significant stock holdings, or other liquid assets however you lack the ability to document income as defined by the IRS we can likely help you if you have been turned down by other […]

How to Get a Home Loan That Closes Fast in California – Use a Private Portfolio Lender Fast Closing Mortgages

People always ask me where can I get a fast closing mortgage in California? What is the fastest I can close a loan? Well I can say with confidence we can help you facilitate a loan that closes fast. We have the fastest closings on FHA purchase loans in the mortgage business. […]

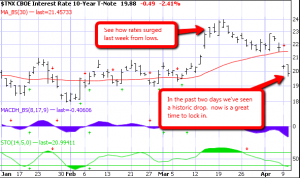

Bay Area Mortgage Rates Hold at Lows After May Jobs Report

Market Commentary from Mortgage Daily Bay Area mortgage rates in the SF and surrounding areas continue to operate at their best levels since early February following Friday’s weaker-than-expected Employment Situation report. There was effectively no change in most lenders’ rate sheet offerings versus Friday morning’s rates. Even last week, there were no dramatic movements into the […]

Mortgage APR Explained, What is the Difference Between and Interest Rate and APR

THE APR (Annual Percentage Rate) CAN BE VERY HELPFUL It is also one of the most misunderstood numbers people find when applying for loans. As consumer loans, and mortgages in particular, turned more complicated it became necessary to help regulate the way lenders advertise and notify the potential borrower of their interest rates. The attempt […]

CA Bay Area Mortgage Rates Inch Back Into Historically Low Territory

Posted by Jason Wheeler | Fully Follow Me | Subscribe After quite a few ticks upward in the last few weeks It looks like mortgage rates have pushed back down to their historic lows in the Contra Costa East Bay Area. If you are in the middle of processing a loan or you are refinancing […]

HARP 2.0 Program 2012 Could Help Many in SF Bay Area – Fannie Mae Home Affordable Refinance Program & Freddie Mac’s Open Access

Posted by Jason Wheeler | Fully Follow Me | Subscribe Update 2/10/2012 – We are now accepting applications for this new program. inquire today right here! and find out about HARP 2 rates today. If you want to learn a whole lot more about HARP 2.0 changes and if you can benefit from them if […]

Why Use A Private Portfolio Mortgage Lender

Posted by Jason Wheeler | Fully Follow Me | Subscribe I’m always talking to people about the benefits of working with myself and C2 Financial Corpcompared to what I call the big three retail lenders. Bank of America, Chase, and Wells Fargo.(Stay Away if you Want a Make Sense Loan! While these big retail […]

What is an Impound Account – Why Do I Need an Escrow Account When I Buy Bay Area Real Estate?

Posted by Jason Wheeler | Subscribe What is an Impound Account? An account maintained by mortgage companies to collect amounts such as hazard insurance, property taxes, private mortgage insurance and other required payments from the mortgage holders; these payments are necessary to keep the home but are not technically part of the mortgage. Impound accounts […]

10 California Private Money Portfolio Lending Scenarios… FUNDED – We Can Close When Your Lender Says NO.

STILL NEED TO CLOSE THIS MONTH??? have a purchase go sideways on last minute? need to get a real appraiser of your choice out there? We are not HARD money!!! Programs: We specializes in loans slightly outside the box, we are not always agency sellers so most of our loans represent agency fallout or turn down’s […]

5 Tips When Finding a Lender. What is the Difference Between a Retail Direct Lender and a Wholesale Mortgage Broker in the CA Bay Area?

Posted by Jason Wheeler | Subscribe Lately I’ve had a lot of questions and concerns from clients and Realtors in the CA Bay Area real estate market place about the difference between a "Direct Lender" a "Retail Lender" and a "Wholesale Broker" What are the main differences and benefits of working with one or the […]

Why is Getting a Financial Mortgage Review is Like Going to the Dentist? Bay Area Financing can be a “Pain”

Posted by Jason Wheeler | New here? Read our feed Getting a financial review or a Mortgage Review is kind of like going to the dentist… Nobody likes going to the dentist, and nobody likes getting teeth pulled and poked at. However if you DON’T get that check up at least twice a year the […]

Continue to Rent or Be Grown up? Five Reasons you Should Buy A Home This Year in the CA Bay Area

Guest Post by Laurie Berry | New here? Read our feed Continue Renting or Be A Grown Up? So you have a stable job and decent credit. Why are you paying money to live in someone else’s home? DO YOUR HOMEWORK! Right now interest rates for home loans are low. Lowest rates in 40 years! […]

15 DAY CLOSING GUARANTEE

Are you shopping for a Mortgage Loan in the California San Francisco Bay Area? Ask us today about our pricing and closing guarantees! We will put it in writing and I’m so confident that I will put my money where my mouth is too!! The Mortgage Process is not always easy and Rates Change on […]

High Balance Jumbo Mortgage Loans in California and San Francisco Bay Area only 20% Down Payment for Purchases!

Posted by Jason Wheeler | Fully Follow Me | Read More When you are looking for a Jumbo High Balance Loan in California or in the Bay Area in general it can be difficult to secure financing for a high end 2nd home or an investment property with a 20% down payment. Most Jumbo […]

Rising Mortgage Rates in Contra Costa Bay Area Area on a Major Uptrend – Lock Your Rate Today with Your Mortgage Broker in the East Bay

Posted by Jason Wheeler | Read our Feed Mortgage Rates in the Bay Area and in California have seen a major uptrend in the last few weeks. If you are sitting on the fence you may want to take advantage and lock in your low rates today! This uptrend could last for some time. Bank […]