Sold By Debbie Wright

Temporary Funding Verification of Employment

CRITICAL UPDATE RE: RE-VERIFICATION OF EMPLOYMENT The following form must be signed just before loan funding. Because of the sudden massive layoffs and job losses due to COVID-19 most lenders have updated their procedures to re-confirm, before funding, the borrower is still employed. If the borrower’s employer cannot verify the borrower is actively still employed and […]

C2 Financial Online Mortgage Application

Apply online quickly with C2 Financial. We can process your mortgage application almost 100% online. Of course your mortgage expert is always ready to help you through the process and available via phone or email. Fill out your C2 Financial mortgage application here and get pre approved same day.

2019 FASTEST MORTGAGE LOAN CLOSINGS IN THE CA BAY AREA

Are you looking for the fastest closing on your home loan or new mortgage? Not only are we a DIRECT LENDER but we also work with over 50 different banks and lending partners all over California. Our team is recognized as a top producing Mortgage Broker among of over 500 throughout California. If you’re looking […]

Fast Bay Area Mortgage Loan Pre Approval

It’s so easy to get a mortgage pre-approval letter. It should only take about 15 minutes on the phone with a good Loan Officer and just a bit of work gathering a few income documents. We specialize in getting you pre approved fast in cities like Pleasant Hill, Walnut Creek, Concord, Martinez and Lafayette, or […]

[CASE STUDY] 10 Day Mortgage Closings on a Home Purchase?

2019 HOME LOAN PURCHASE CLOSED IN JUST 12 DAYS In this most recent case study we closed this purchase loan in just 12 days!! The loan was submitted on August 28th 2019 and we had closing docs ready on 9/11/2019 We closed this purchase loan in only 10 days! In this recent case study I […]

Thinking of Buying in 2019?

Here is the latest on East Bay Area Down Payment Options. Look over my shoulder, as I compare low down payment options to our zero down payment option that many home buyers are getting approved for recently. In this quick 10 minute video, I will show you a real life scenario comparison between two popular […]

Bay Area Reverse Mortgages

Seniors all around Pleasant Hill are taking control of their finances without giving away their lifestyle. Did you know that the home equity conversion mortgage that is federally insured can help you purchase a home with no monthly payments, or refinance your current home with no monthly payments, if you are 62 and older. Many […]

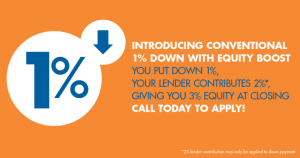

Buying A Bay Area House with A Low Down Payment Loan

Did you know that you can still buy a home with a low down payment mortgage with using as little as 1% of your own money for your down payment? Before the market crashed in 2007 “no down payment loans” were used on almost every transaction when first time home buyers with limited to no […]

GETTING YOUR CLOSING COSTS PAID FOR

YOU BUY WE PAY CLOSING! For a limited time we are offering to PAY FOR ALL CLOSING FEES on your home purchase! You might ask “How they heck can you pay for all the closing fees and still make a living?” There are terms and conditions for this offer and we will only offer this […]

EAST BAY REAL ESTATE MARKET TREND REPORT

Do you have a goal setting method that you use on a regular basis in order to plan and attain your goals yearly, quarterly, or monthly? A couple weeks ago I told you that I was going share my 2016 goals with you. Here they are. I wanted to share my goals this year for […]

JUMBO PURCHASE LOANS UP TO 90% LTV PURCHASE 10% DOWN NO MORTGAGE INSURANCE

Here are some of the main point and highlights for our Jumbo purchase loans up to 90% loan to value ratio (90% LTV) or as little as just 10% down payment on your purchase. If you are looking to make a large Real Estate Purchase in the East Bay area in a city like […]

Can you Get a Jumbo Loan After a Foreclosure Short Sale or Bankruptcy?

“Can you get a jumbo loan after a foreclosure short sale or bankruptcy?” This is a question that I am asked on a regular basis from all kinds of consumers that suffered from a recent housing event like a foreclosure, short sale or bankruptcy since the housing crash and foreclosure crisis that occurred nationwide in […]

FHA MORTGAGE LOAN RULES – INSURANCE RATE LOWERED

FHA mortgage loan rules in the bay area have recently changed. I thought you would be interested to know about this if you haven’t heard yet. This could be good for any FHA buyers that are on the fence and save them some money. You can learn more about FHA guidelines and rules here. However […]

FIX AND FLIP LOANS BASED ON AFTER REPAIRED VALUE

LENDING TERMS FOR FIX AND FLIP INVESTORS IN THE BAY AREA Fix and Flip loans for investors based on after repaired value (ARV)? This unique loan program allows investors to secure financing based on the “After Repaired Value” of a home with very low interest only payments. Basically we will lend up front on the […]

HOME LOAN 1 DAY AFTER SHORT SALE, FORECLOSURE OR BK?

YES we can get you a loan to purchase real estate right after a short sale or foreclosure. This is offered through a private money financial institution that we have a special relationship with. We are actively helping people with a recent housing event get back into the housing market. Private money is a commonly […]

Major Mistakes to Avoid When Buying Real Estate

Not too long ago I wrote up a list of things that will surely destroy your ability to secure a real estate loan. You will definitely want to learn about the major mistakes to avoid when buying Real Estate Many consumers that are shopping with a pre-approval letter don’t realize that you can really screw […]

HOME LOAN RIGHT AFTER SHORT SALE OR FORECLOSURE

Are you wondering… “Can I get a home loan right after a short sale in the SF Bay Area?” The answer is YES you CAN get a loan recently after a short sale or a foreclosure with the 2nd chance home loan. Not every lender offers this and not every borrower will qualify. See the […]