The Real Estate market forecast to be great for potential home buyers that were frustrated with massive competition in the few years past. People always ask me… “How do I buy a house in the Bay Area?” If you are looking to buy in the Diablo Valley East Bay Area? We focus and specialize in […]

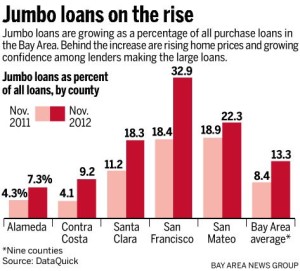

Bay Area Stated Income Jumbo Financing? Diablo Valley Luxury

These stated income loans in the California Bay Area go up to 5 million 80% LTV as little as 20% down payment. No tax returns, no W2s or pay stubs needed. Send us your scenario. WHO CAN QUALIFY FOR STATED INCOME PROGRAM? This Bay Area Stated Income Loan program is specifically intended for people in […]

JUMBO PURCHASE LOANS UP TO 90% LTV PURCHASE 10% DOWN NO MORTGAGE INSURANCE

Here are some of the main point and highlights for our Jumbo purchase loans up to 90% loan to value ratio (90% LTV) or as little as just 10% down payment on your purchase. If you are looking to make a large Real Estate Purchase in the East Bay area in a city like […]

Can you Get a Jumbo Loan After a Foreclosure Short Sale or Bankruptcy?

“Can you get a jumbo loan after a foreclosure short sale or bankruptcy?” This is a question that I am asked on a regular basis from all kinds of consumers that suffered from a recent housing event like a foreclosure, short sale or bankruptcy since the housing crash and foreclosure crisis that occurred nationwide in […]

STATED INCOME MORTGAGE LOANS IN CALIFORNIA ARE BACK

SEND YOUR BAY AREA STATED INCOME SCENARIO HERE Stated income loan programs were first introduced in the early 200s primarily for the “self-employed” borrower who had trouble getting clear documentation or an accurate representation of what they actually make. Later on in 2007 stated income loans were given to just about anyone with decent credit. […]

Secret Private Money: 13 Scenarios California Direct Private Portfolio Lender Funded When Banks Said “NO”

Thanks for being here. In this posting I will show you several portfolio scenarios that can help you close more transactions when other conventional lenders tell you and your client NO. As a bonus check out my crash course on some of the most common lending questions for first time home buyers. When you have […]

Walnut Creek Jumbo Loans: What is the Lowest Rate Today and What Exactly is a Jumbo Loan?

Jumbo mortgage loans for Walnut Creek CA homes can be hard to get approved for if you aren’t working with a Loan Officer or Mortgage Broker that knows exactly how to structure your loan. Most consumers applying for these large Jumbo Loans in the Walnut Creek area have complicated tax returns with K-1s and many […]

California Portfolio Lenders – What is Portfolio Private Lending?

What is the definition of Portfolio Private Lending and what California lenders offer this? It can be frustrating and difficult to find a private lender that is willing to fund a loan that does not exactly fit into the conventional financing box. Although we offer the best in Conventional and FHA Government Loans… We also […]

Using Assets as Income to Qualify For a California Mortgage Loan

Asset based lending in CA Bay Area Cities like Walnut Creek, Lafayette, Orinda and Pleasant Hill is alive and well. Did you know that if you have a large amount for liquid assets in a mutual fund or stock account, but you are having trouble documenting income as defined by the IRS on your […]

Bay Area Jumbo Loans Approved When Other Lenders Say No – Plegded Assets and Asset Depletion Are Okay!

C2 Financial and Jason Wheeler have some unique products that will help you get a jumbo loan closed. If you have significant stock holdings, or other liquid assets however you lack the ability to document income as defined by the IRS we can likely help you if you have been turned down by other […]

How to Get a Home Loan That Closes Fast in California – Use a Private Portfolio Lender Fast Closing Mortgages

People always ask me where can I get a fast closing mortgage in California? What is the fastest I can close a loan? Well I can say with confidence we can help you facilitate a loan that closes fast. We have the fastest closings on FHA purchase loans in the mortgage business. […]

Why Use A Private Portfolio Mortgage Lender

Posted by Jason Wheeler | Fully Follow Me | Subscribe I’m always talking to people about the benefits of working with myself and C2 Financial Corpcompared to what I call the big three retail lenders. Bank of America, Chase, and Wells Fargo.(Stay Away if you Want a Make Sense Loan! While these big retail […]

10 California Private Money Portfolio Lending Scenarios… FUNDED – We Can Close When Your Lender Says NO.

STILL NEED TO CLOSE THIS MONTH??? have a purchase go sideways on last minute? need to get a real appraiser of your choice out there? We are not HARD money!!! Programs: We specializes in loans slightly outside the box, we are not always agency sellers so most of our loans represent agency fallout or turn down’s […]

High Balance Jumbo Mortgage Loans in California and San Francisco Bay Area only 20% Down Payment for Purchases!

Posted by Jason Wheeler | Fully Follow Me | Read More When you are looking for a Jumbo High Balance Loan in California or in the Bay Area in general it can be difficult to secure financing for a high end 2nd home or an investment property with a 20% down payment. Most Jumbo […]

Getting a Jumbo Loan in California Above $700,000 – High Balance Loans up to 5 Million – 10 Reasons to Apply With Us!

Posted by Jason Wheeler | Fully Follow Me | Read More Investor relationships are key when you are referring to getting a loan. Especially if you are applying for a Jumbo Loan amount above $700,000. In today’s volatile lending environment it has become more and more difficult to secure financing especially for large loans and […]