CRITICAL UPDATE RE: RE-VERIFICATION OF EMPLOYMENT The following form must be signed just before loan funding. Because of the sudden massive layoffs and job losses due to COVID-19 most lenders have updated their procedures to re-confirm, before funding, the borrower is still employed. If the borrower’s employer cannot verify the borrower is actively still employed and […]

How Coronavirus Shelter in Place Closing is Affecting Mortgages

HOW SHELTER IN PLACE IS EFFECTING HOME FINANCING See in detail how the new 2020 recession is effecting mortgage rates here. Fannie Mae, Freddie Mac offer help to homeowners in COVID-19 crisis Two of the country’s best-known mortgage lenders want to help people to keep their homes. Fannie Mae and Freddie Mac both released statements […]

2020 Refinance Boom – Coronavirus Market Crash!

Due to everything that is going on with the Coronavirus, markets crashing, and overall fast paced changes we’ve been seeing, we wanted to keep you updated as things change and develop in the mortgage markets. How is lending affected? How will this affect real estate transactions? Just about EVERY INDUSTRY and every person will be […]

2019 FASTEST MORTGAGE LOAN CLOSINGS IN THE CA BAY AREA

Are you looking for the fastest closing on your home loan or new mortgage? Not only are we a DIRECT LENDER but we also work with over 50 different banks and lending partners all over California. Our team is recognized as a top producing Mortgage Broker among of over 500 throughout California. If you’re looking […]

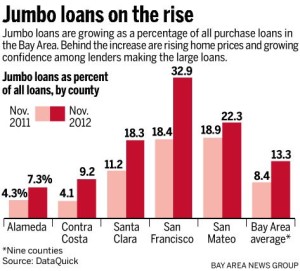

Bay Area Stated Income Jumbo Financing? Diablo Valley Luxury

These stated income loans in the California Bay Area go up to 5 million 80% LTV as little as 20% down payment. No tax returns, no W2s or pay stubs needed. Send us your scenario. WHO CAN QUALIFY FOR STATED INCOME PROGRAM? This Bay Area Stated Income Loan program is specifically intended for people in […]

Bay Area Home Prices Rising Or Falling?

HOME PRICES FALLING OR INCREASING WITH MORTGAGE RATES? Are Bay Area home prices going to continue increasing or will they begin falling in 2017? Today, in this quick video, I wanted to hang out with you for just a few minutes and talk a little bit about the direction of mortgage rates since the election […]

VIDEO: MORTGAGE RATE FORECAST JUNE 2015

I’ve been getting some great feedback from recent market updates I’ve been doing on YouTube and mailing out to my list. Here is an example of my most recent Weekly Wrap Up. Those of you that have been responding personally via email or with a phone call or signing up for our most recent classes […]

JUMBO PURCHASE LOANS UP TO 90% LTV PURCHASE 10% DOWN NO MORTGAGE INSURANCE

Here are some of the main point and highlights for our Jumbo purchase loans up to 90% loan to value ratio (90% LTV) or as little as just 10% down payment on your purchase. If you are looking to make a large Real Estate Purchase in the East Bay area in a city like […]

Can you Get a Jumbo Loan After a Foreclosure Short Sale or Bankruptcy?

“Can you get a jumbo loan after a foreclosure short sale or bankruptcy?” This is a question that I am asked on a regular basis from all kinds of consumers that suffered from a recent housing event like a foreclosure, short sale or bankruptcy since the housing crash and foreclosure crisis that occurred nationwide in […]

STATED INCOME MORTGAGE LOANS IN CALIFORNIA ARE BACK

SEND YOUR BAY AREA STATED INCOME SCENARIO HERE Stated income loan programs were first introduced in the early 200s primarily for the “self-employed” borrower who had trouble getting clear documentation or an accurate representation of what they actually make. Later on in 2007 stated income loans were given to just about anyone with decent credit. […]

Jumbo Loan Requirements for Cashout to 80% LTV: Recoup of Funds Used for the Recent Purchase of the Subject Property

If a borrower purchased the subject property for cash within the last 12 months, refer to the guidelines below for Loan-to-Value/LTV Determination for Property Owned Less Than One Year and Recoup of Funds Used for the Recent Purchase of the Subject Property. If a borrower was added to title or received the property as a […]

Walnut Creek Jumbo Loans: What is the Lowest Rate Today and What Exactly is a Jumbo Loan?

Jumbo mortgage loans for Walnut Creek CA homes can be hard to get approved for if you aren’t working with a Loan Officer or Mortgage Broker that knows exactly how to structure your loan. Most consumers applying for these large Jumbo Loans in the Walnut Creek area have complicated tax returns with K-1s and many […]

Using Assets as Income to Qualify For a California Mortgage Loan

Asset based lending in CA Bay Area Cities like Walnut Creek, Lafayette, Orinda and Pleasant Hill is alive and well. Did you know that if you have a large amount for liquid assets in a mutual fund or stock account, but you are having trouble documenting income as defined by the IRS on your […]

Bay Area Jumbo Loans Approved When Other Lenders Say No – Plegded Assets and Asset Depletion Are Okay!

C2 Financial and Jason Wheeler have some unique products that will help you get a jumbo loan closed. If you have significant stock holdings, or other liquid assets however you lack the ability to document income as defined by the IRS we can likely help you if you have been turned down by other […]

High Balance Jumbo Mortgage Loans in California and San Francisco Bay Area only 20% Down Payment for Purchases!

Posted by Jason Wheeler | Fully Follow Me | Read More When you are looking for a Jumbo High Balance Loan in California or in the Bay Area in general it can be difficult to secure financing for a high end 2nd home or an investment property with a 20% down payment. Most Jumbo […]

Getting a Jumbo Loan in California Above $700,000 – High Balance Loans up to 5 Million – 10 Reasons to Apply With Us!

Posted by Jason Wheeler | Fully Follow Me | Read More Investor relationships are key when you are referring to getting a loan. Especially if you are applying for a Jumbo Loan amount above $700,000. In today’s volatile lending environment it has become more and more difficult to secure financing especially for large loans and […]