Looking for a Bay Area Mortgage Pre Approval? The home loan process in the Bay Area can be full of challenges and “turbulence” sometimes. Rest assured the challenges are 100% worth it in order to become a home owner. If you want to cut to the chase and get your pre approval just go here. […]

Fast Bay Area Mortgage Loan Pre Approval

It’s so easy to get a mortgage pre-approval letter. It should only take about 15 minutes on the phone with a good Loan Officer and just a bit of work gathering a few income documents. We specialize in getting you pre approved fast in cities like Pleasant Hill, Walnut Creek, Concord, Martinez and Lafayette, or […]

Reviews and Testimonials for Pleasant Hill Bay Area Mortage Broker Jason Wheeler

Nothing makes my day quite like a local reviews from an amazing client in my home town of Pleasant Hill CA for my Mortgage Broker services. Thanks so much to my happy clients that truly make it all worth it. She made this review in March of 2013 on the popular site Yelp.com Review for […]

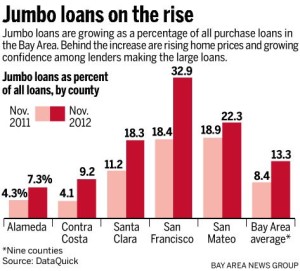

Walnut Creek Jumbo Loans: What is the Lowest Rate Today and What Exactly is a Jumbo Loan?

Jumbo mortgage loans for Walnut Creek CA homes can be hard to get approved for if you aren’t working with a Loan Officer or Mortgage Broker that knows exactly how to structure your loan. Most consumers applying for these large Jumbo Loans in the Walnut Creek area have complicated tax returns with K-1s and many […]

Bay Area Mortgage Broker Talks About Today’s Rate Trends After Hurricane Sandy

Mortgage backed securities tanked the first day the money markets were open after Hurricane Sandy however bay area mortgage rates remain steady and mostly unchanged. After two days with the markets being closed due to the horrible storm on the east coast the Bay Area Mortgage Rates open a bit lower than they were […]

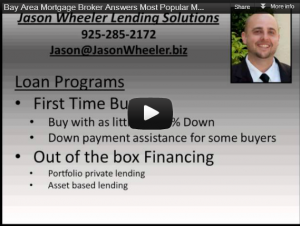

Bay Area Jumbo Loans Approved When Other Lenders Say No – Plegded Assets and Asset Depletion Are Okay!

C2 Financial and Jason Wheeler have some unique products that will help you get a jumbo loan closed. If you have significant stock holdings, or other liquid assets however you lack the ability to document income as defined by the IRS we can likely help you if you have been turned down by other […]

How to Get a Home Loan That Closes Fast in California – Use a Private Portfolio Lender Fast Closing Mortgages

People always ask me where can I get a fast closing mortgage in California? What is the fastest I can close a loan? Well I can say with confidence we can help you facilitate a loan that closes fast. We have the fastest closings on FHA purchase loans in the mortgage business. […]

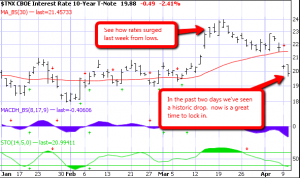

Bay Area Mortgage Rates Hold at Lows After May Jobs Report

Market Commentary from Mortgage Daily Bay Area mortgage rates in the SF and surrounding areas continue to operate at their best levels since early February following Friday’s weaker-than-expected Employment Situation report. There was effectively no change in most lenders’ rate sheet offerings versus Friday morning’s rates. Even last week, there were no dramatic movements into the […]

Mortgage APR Explained, What is the Difference Between and Interest Rate and APR

THE APR (Annual Percentage Rate) CAN BE VERY HELPFUL It is also one of the most misunderstood numbers people find when applying for loans. As consumer loans, and mortgages in particular, turned more complicated it became necessary to help regulate the way lenders advertise and notify the potential borrower of their interest rates. The attempt […]

CA Bay Area Mortgage Rates Inch Back Into Historically Low Territory

Posted by Jason Wheeler | Fully Follow Me | Subscribe After quite a few ticks upward in the last few weeks It looks like mortgage rates have pushed back down to their historic lows in the Contra Costa East Bay Area. If you are in the middle of processing a loan or you are refinancing […]

HARP 2.0 Program 2012 Could Help Many in SF Bay Area – Fannie Mae Home Affordable Refinance Program & Freddie Mac’s Open Access

Posted by Jason Wheeler | Fully Follow Me | Subscribe Update 2/10/2012 – We are now accepting applications for this new program. inquire today right here! and find out about HARP 2 rates today. If you want to learn a whole lot more about HARP 2.0 changes and if you can benefit from them if […]

Why Use A Private Portfolio Mortgage Lender

Posted by Jason Wheeler | Fully Follow Me | Subscribe I’m always talking to people about the benefits of working with myself and C2 Financial Corpcompared to what I call the big three retail lenders. Bank of America, Chase, and Wells Fargo.(Stay Away if you Want a Make Sense Loan! While these big retail […]

What is an Impound Account – Why Do I Need an Escrow Account When I Buy Bay Area Real Estate?

Posted by Jason Wheeler | Subscribe What is an Impound Account? An account maintained by mortgage companies to collect amounts such as hazard insurance, property taxes, private mortgage insurance and other required payments from the mortgage holders; these payments are necessary to keep the home but are not technically part of the mortgage. Impound accounts […]

10 California Private Money Portfolio Lending Scenarios… FUNDED – We Can Close When Your Lender Says NO.

STILL NEED TO CLOSE THIS MONTH??? have a purchase go sideways on last minute? need to get a real appraiser of your choice out there? We are not HARD money!!! Programs: We specializes in loans slightly outside the box, we are not always agency sellers so most of our loans represent agency fallout or turn down’s […]

5 Tips When Finding a Lender. What is the Difference Between a Retail Direct Lender and a Wholesale Mortgage Broker in the CA Bay Area?

Posted by Jason Wheeler | Subscribe Lately I’ve had a lot of questions and concerns from clients and Realtors in the CA Bay Area real estate market place about the difference between a "Direct Lender" a "Retail Lender" and a "Wholesale Broker" What are the main differences and benefits of working with one or the […]