Looking for a Bay Area Mortgage Pre Approval? The home loan process in the Bay Area can be full of challenges and “turbulence” sometimes. Rest assured the challenges are 100% worth it in order to become a home owner. If you want to cut to the chase and get your pre approval just go here. […]

Fast Bay Area Mortgage Loan Pre Approval

It’s so easy to get a mortgage pre-approval letter. It should only take about 15 minutes on the phone with a good Loan Officer and just a bit of work gathering a few income documents. We specialize in getting you pre approved fast in cities like Pleasant Hill, Walnut Creek, Concord, Martinez and Lafayette, or […]

Bay Area Stated Income Jumbo Financing? Diablo Valley Luxury

These stated income loans in the California Bay Area go up to 5 million 80% LTV as little as 20% down payment. No tax returns, no W2s or pay stubs needed. Send us your scenario. WHO CAN QUALIFY FOR STATED INCOME PROGRAM? This Bay Area Stated Income Loan program is specifically intended for people in […]

CONCORD CA MORTGAGE BROKER HOUSING NEWS

When you are looking for a Mortgage Broker in Concord CA give us a shout. Read the rest of the article here If you enjoyed keeping up with this info, can you do me a huge favor please? Can you “like” my business page here if you are on Facebook. ——————————- I truly value and appreciate my […]

Reviews and Testimonials for Pleasant Hill Bay Area Mortage Broker Jason Wheeler

Nothing makes my day quite like a local reviews from an amazing client in my home town of Pleasant Hill CA for my Mortgage Broker services. Thanks so much to my happy clients that truly make it all worth it. She made this review in March of 2013 on the popular site Yelp.com Review for […]

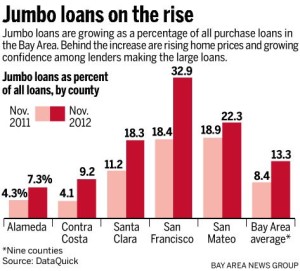

Walnut Creek Jumbo Loans: What is the Lowest Rate Today and What Exactly is a Jumbo Loan?

Jumbo mortgage loans for Walnut Creek CA homes can be hard to get approved for if you aren’t working with a Loan Officer or Mortgage Broker that knows exactly how to structure your loan. Most consumers applying for these large Jumbo Loans in the Walnut Creek area have complicated tax returns with K-1s and many […]

California Mortgage Brokers – Bay Area Loan Rates Continue Upward, Is the Refinance Boom Alomost Over?

Mortgage interest rates are ticking up a bit in the California Bay Area and nationwide as well. Does this mean you’ve missed your window to refinance into the the lowest interest rates we’ve ever seen in history… Will you still be able to refinance or will you have to resort to a private portfolio lender? […]

GET A BAY AREA HOME LOAN WHEN THE PROPERTY IS AN INVESTOR FLIP

How can you get a mortgage in the CA Bay Area when the subject property is an investor flip? It was pretty exciting to go into the Labor Day holiday this week knowing my amazing clients who found me on the popular site Yelp.com from the great reviews on the site a few months back […]

Bay Area Jumbo Loans Approved When Other Lenders Say No – Plegded Assets and Asset Depletion Are Okay!

C2 Financial and Jason Wheeler have some unique products that will help you get a jumbo loan closed. If you have significant stock holdings, or other liquid assets however you lack the ability to document income as defined by the IRS we can likely help you if you have been turned down by other […]

How to Get a Home Loan That Closes Fast in California – Use a Private Portfolio Lender Fast Closing Mortgages

People always ask me where can I get a fast closing mortgage in California? What is the fastest I can close a loan? Well I can say with confidence we can help you facilitate a loan that closes fast. We have the fastest closings on FHA purchase loans in the mortgage business. […]

Bay Area Mortgage Rates Hold at Lows After May Jobs Report

Market Commentary from Mortgage Daily Bay Area mortgage rates in the SF and surrounding areas continue to operate at their best levels since early February following Friday’s weaker-than-expected Employment Situation report. There was effectively no change in most lenders’ rate sheet offerings versus Friday morning’s rates. Even last week, there were no dramatic movements into the […]

Mortgage APR Explained, What is the Difference Between and Interest Rate and APR

THE APR (Annual Percentage Rate) CAN BE VERY HELPFUL It is also one of the most misunderstood numbers people find when applying for loans. As consumer loans, and mortgages in particular, turned more complicated it became necessary to help regulate the way lenders advertise and notify the potential borrower of their interest rates. The attempt […]

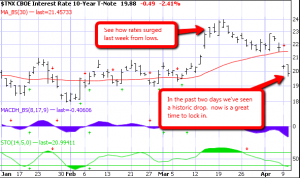

CA Bay Area Mortgage Rates Inch Back Into Historically Low Territory

Posted by Jason Wheeler | Fully Follow Me | Subscribe After quite a few ticks upward in the last few weeks It looks like mortgage rates have pushed back down to their historic lows in the Contra Costa East Bay Area. If you are in the middle of processing a loan or you are refinancing […]

HARP 2.0 Program 2012 Could Help Many in SF Bay Area – Fannie Mae Home Affordable Refinance Program & Freddie Mac’s Open Access

Posted by Jason Wheeler | Fully Follow Me | Subscribe Update 2/10/2012 – We are now accepting applications for this new program. inquire today right here! and find out about HARP 2 rates today. If you want to learn a whole lot more about HARP 2.0 changes and if you can benefit from them if […]

Why Use A Private Portfolio Mortgage Lender

Posted by Jason Wheeler | Fully Follow Me | Subscribe I’m always talking to people about the benefits of working with myself and C2 Financial Corpcompared to what I call the big three retail lenders. Bank of America, Chase, and Wells Fargo.(Stay Away if you Want a Make Sense Loan! While these big retail […]