Posted by Jason Wheeler | Fully Follow Me | Subscribe

Update 2/10/2012 – We are now accepting applications for this new program. inquire today right here! and find out about HARP 2 rates today.

If you want to learn a whole lot more about HARP 2.0 changes and if you can benefit from them if you own a home in the CA Bay Area you can download the official FAQ guide right here too.

You can also simply go to the contact us page above and give me a call anytime too!

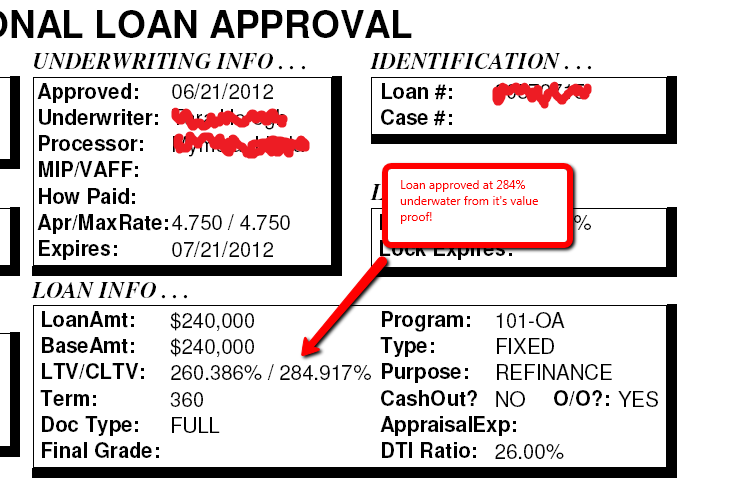

I’m excited about our newest update to the Harp Program we currently are getting unlimited loan to value approved loans. See for yourself the approval on 6/12/2012 at 284% loan to value ratio.

Update 1/25/2012 – This program is set to be released in March 2012. Right now there is a huge back log of people pre-applying so the process may take some time. Apply today for this program and get your file ready and in line when it is released in March 2012.

What is the HARP Program? (Home Affordable Refinance Program)

Learn about all the HARP 2 rules, guidelines and rates today. All the details are right below.

New changes are coming to the HARP program on November 11th 2011 that should help thousands keep their homes and save a ton of money in the SF Bay Area!

For a mortgage to be considered for a HARP refinance in the California Bay Area, it must be owned or guaranteed by Fannie Mae or Freddie Mac.

If your home is or will be “underwater” you need to take a look at this program today.

Important Steps to Applying for a HARP Loan

- To determine if your loan is owned or guaranteed by Fannie Mae or Freddie Mac, you may verify it yourself by going here

- Did you get your loan before June of 2009?

- If your loan is a Fannie Mae loan, you may obtain more information on the program, here.

- If your loan is a Freddie Mac loan, you may obtain more information here.

- If you would like to apply for a HARP Relief Refinance today you can inquire here.

———————————————————————————————-

If your loan is not a Fannie Mae or a Freddie Mac loan, your loan is not covered by the HARP refinance program. You may want to contact your servicer or other lenders to discuss refinance programs you may be eligible for. For more information see: FHFA HARP page.

If your loan is not a Fannie Mae or a Freddie Mac loan, your loan is not covered by the HARP refinance program. You may want to contact your servicer or other lenders to discuss refinance programs you may be eligible for. For more information see: FHFA HARP page.

—————————————————————–

Some of the new guidelines and rules that were announce by President Obama and the Federal Housing Finance Agency are as follows.

The new program enhancements address several other key aspects of HARP including:

- Eliminating certain risk-based fees for borrowers who refinance into shorter-term

mortgages and lowering fees for other borrowers; - Removing the current 125% percent LTV ceiling for fixed-rate mortgages backed by

Fannie Mae and Freddie Mac; - Waiving certain representations and warranties that lenders commit to in making loans

owned or guaranteed by Fannie Mae and Freddie Mac; - Eliminating the need for a new property appraisal where there is a reliable AVM

(automated valuation model) estimate provided by the Enterprises; and - Extending the end date for HARP until Dec. 31, 2013 for loans originally sold to the

Enterprises on or before May 31, 2009.

You can review the official press release and new rules from the FHFA Here.

If you would like to apply for a HARP Relief Refinance today you can inquire here.

——————————————————————

The Home Affordable Refinance Program HARP is alive and well in the SF Bay Area. Most lenders will go up to 110% of your homes current value however we work with several lenders that will allow for up to 125% of the homes value.

President Barack Obama announced a set of new rules recently designed to make it easier for homeowners to refinance their mortgages even if they owe more than their home is worth.

Bay Area lawmakers had pushed hard for the changes, which eliminate some fees and ease rules on refinancing home loans owned by the government-controlled mortgage finance companies Fannie Mae and Freddie Mac. For more than a year, Sen. Barbara Boxer (D-California) has been pushing legislation that would force Fannie Mae and Freddie Mac to help people reduce the amount they owe on their mortgage.

In a statement Monday, Boxer said she was “very pleased” with the new changes and would urge the Federal Housing Finance Agency, which regulates Fannie Mae and Freddie Mac, “to move swiftly to assure that these new policies will help as many homeowners as possible.”

President Obama threw a lifeline to some underwater homeowners Monday in announcing his administration will revamp a program to refinance homes with mortgages greater than their current values.

“This will help a lot more homeowners refinance at lower rates,” Obama said, speaking in a modest neighborhood in Las Vegas, a city walloped by foreclosures. The president said he would do “everything in my power to help stabilize the housing market.”

The plan will streamline and expand the existing Home Affordable Refinance Program, or HARP, to make it easier to use with fewer fees, broader eligibility and no limit on how far underwater a home can be. The program so far has helped about 894,000 homeowners, far shy of the projected 5 million when it was rolled out two years ago.

Underwater homeowners who qualify will be able to take advantage of today’s bargain-basement interest rates, which are around 4 percent. Since many are now stuck with much higher interest rates, they should save several hundred dollars a month by refinancing.

“This will help a lot more homeowners refinance at lower rates,” Obama said, speaking in a modest neighborhood in Las Vegas, a city walloped by foreclosures. The president said he would do “everything in my power to help stabilize the housing market.” Read more form the San Francisco Chronicle on this

We will see how long it takes for banks to start implementing or if they even will implement these new rules for stressed home owners. So far the HARP Home Affordable Refinance Program has not helped as many Bay Area Home owners that is was designed for.

Leave Me a Quick Comment or Note