Thank you very much for reading and downloading this Bay Area Real Estate Consumer Awareness Guide. The reason for this handbook is so that you could gain more knowledge and awareness in regards to purchasing a home here in the Diablo Valley in Contra Costa County. Purchasing and financing a home can be one of […]

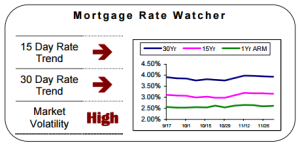

DECEMBER 2015 MORTGAGE RATE WATCHING

UPDATE: yup they finally did it… the FED raised rates. The Federal Reserve did it — raised the target federal funds rate a quarter point, its first boost in nearly a decade. That does not, however, mean that the average rate on the 30-year fixed mortgage will be a quarter point higher when we all […]

BIG CHANGES TO FHA HUD LOANS SEPTEMPER 15th 2015

If you or a family member are in the process of trying to buy a home, then you should know that new changes to FHA Loan Guidelines may drastically affect the ability of new home buyers to qualify for a home loan. You need to know this if you have student loans or plan to […]

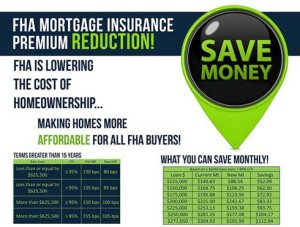

LOWER OR REMOVE MORTGAGE INSURANCE ON MY FHA LOAN

If you recently bought real estate or own a home and you use an FHA mortgage in order to purchase in the year 2014 he would do yourself a favor by looking into the FHA streamline refinance. MORTGAGE INSURANCE LOWERED ON FHA If you recently bought a home using HUDs FHA loan than you may […]

VIDEO: MORTGAGE RATE FORECAST JUNE 2015

I’ve been getting some great feedback from recent market updates I’ve been doing on YouTube and mailing out to my list. Here is an example of my most recent Weekly Wrap Up. Those of you that have been responding personally via email or with a phone call or signing up for our most recent classes […]

Bay Area Home Loan Closing Costs Estimates & Calculator

Clients who are looking to buy Real Estate in Bay Area cities like Pleasant Hill, Martinez, Walnut Creek and Lafayette who come to me often ask me about closing costs and how to explain them. To answer your questions: Closing costs can be taken care of in three ways in most cases. Buyer pays all […]

JUMBO PURCHASE LOANS UP TO 90% LTV PURCHASE 10% DOWN NO MORTGAGE INSURANCE

Here are some of the main point and highlights for our Jumbo purchase loans up to 90% loan to value ratio (90% LTV) or as little as just 10% down payment on your purchase. If you are looking to make a large Real Estate Purchase in the East Bay area in a city like […]

FHA MORTGAGE LOAN RULES – INSURANCE RATE LOWERED

FHA mortgage loan rules in the bay area have recently changed. I thought you would be interested to know about this if you haven’t heard yet. This could be good for any FHA buyers that are on the fence and save them some money. You can learn more about FHA guidelines and rules here. However […]

MORTGAGE RATE LOCK RECOMENDATIONS DECEMBER 5TH 2014

If I were considering financing/refinancing a home, I would…. Lock if my closing was taking place within 7 days… Lock if my closing was taking place between 8 and 20 days… Lock if my closing was taking place between 21 and 60 days… Lock if my closing was taking place over 60 days from now… […]

QUALIFYING FOR A MORTGAGE AFTER A SHORT SALE OR FORECLOSURE

If you are looking for qualifying for a mortgage just after you had a short sale, foreclosure or bankruptcy our private portfolio loan programs will help you. VIDEO: GETTING A LOAN AFTER SHORT SALE OR FORECLOSURE HERE ARE SOME OF THE HIGHLIGHTS ON OUR PORTFOLIO LOAN PROGRAM • 24 months seasoning for foreclosure, short sale, […]

SF BAY AREA MORTGAGE RATE TRENDS MAJOR RATE DROP

If you want an up to date trend report on exactly what bay area mortgage rate trends are doing watch the video below. The rate drop today was so significant I decided to make a quick 6 minute video showing you how I stack up to my competition and why anyone that recently bought a […]

FIX AND FLIP LOANS BASED ON AFTER REPAIRED VALUE

LENDING TERMS FOR FIX AND FLIP INVESTORS IN THE BAY AREA Fix and Flip loans for investors based on after repaired value (ARV)? This unique loan program allows investors to secure financing based on the “After Repaired Value” of a home with very low interest only payments. Basically we will lend up front on the […]

HOME LOAN 1 DAY AFTER SHORT SALE, FORECLOSURE OR BK?

YES we can get you a loan to purchase real estate right after a short sale or foreclosure. This is offered through a private money financial institution that we have a special relationship with. We are actively helping people with a recent housing event get back into the housing market. Private money is a commonly […]

SURVEY: WHY REALTORS LOVE or “HATE” LOAN OFFICERS

PLEASE HELP ME… MY GOAL IS TO HAVE A STUDY SET OF AT LEAST 200 REALTORS Can I please ask for 1 minute of your time? Will you fill out this survey? All great top producing REALTORS needs relationships with a great Loan Officer… What makes the perfect partnership between Agent and Lender? C’mon… Lets […]

INFO CHART: WHEN THE FED MEETS THE MARKETS REACT

When the FED speaks the markets react… and today they did not react positively for the consumers that are still looking to buy Real Estate in the California Bay Area… In an already expensive market when rates rise 1% it dissolves a borrowers ability purchase by $100,000. Two things are likely to happen… Prices will […]

Debt Reduction Sheet Training: Worksheet Download xls

Thanks so much for being here! My readers and subscribers truly mean the world to me. I appreciate you! If you watch this training and download my full version of this debt reduction sheet please click the link on the right and subscribe to this blog. I will only send you massive value! Debt Reduction […]

Less Bay Area Homes Underwater Now

With some amazing appreciation in the last year and hopes pretty high for the summer to come, many Bay Area home owners that have been “underwater” on their loan for years are beginning to see equity. This is giving many the opportunity to sell or refinance into loans with better terms finally. The fact is […]

HOME LOAN RIGHT AFTER SHORT SALE OR FORECLOSURE

Are you wondering… “Can I get a home loan right after a short sale in the SF Bay Area?” The answer is YES you CAN get a loan recently after a short sale or a foreclosure with the 2nd chance home loan. Not every lender offers this and not every borrower will qualify. See the […]

Jumbo Loan Requirements for Cashout to 80% LTV: Recoup of Funds Used for the Recent Purchase of the Subject Property

If a borrower purchased the subject property for cash within the last 12 months, refer to the guidelines below for Loan-to-Value/LTV Determination for Property Owned Less Than One Year and Recoup of Funds Used for the Recent Purchase of the Subject Property. If a borrower was added to title or received the property as a […]