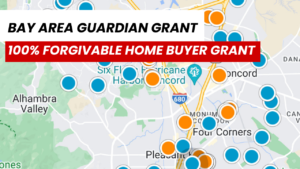

Bay area down payment assistance and first-time homebuyer grant that is 100% forgivable? Everyone should know about this down payment program, it’s the closest thing to “free money” I’ve seen in the real estate industry. While all assistance programs have pros and cons, this one comes with very few strings attached. This program works in […]

Temporary Funding Verification of Employment

CRITICAL UPDATE RE: RE-VERIFICATION OF EMPLOYMENT The following form must be signed just before loan funding. Because of the sudden massive layoffs and job losses due to COVID-19 most lenders have updated their procedures to re-confirm, before funding, the borrower is still employed. If the borrower’s employer cannot verify the borrower is actively still employed and […]

2020 Refinance Boom – Coronavirus Market Crash!

Due to everything that is going on with the Coronavirus, markets crashing, and overall fast paced changes we’ve been seeing, we wanted to keep you updated as things change and develop in the mortgage markets. How is lending affected? How will this affect real estate transactions? Just about EVERY INDUSTRY and every person will be […]

Using Your Bay Area Home as Part of your Financial Plan

Seems like EVERYONE wants to offer you a home value report right? When you get online everyone and their mother wants to give you a valuation on your home? Boring right? Are you looking for an ACCURATE home value report for your Bay Area home that you can count on and refer back to on […]

[CASE STUDY] 10 Day Mortgage Closings on a Home Purchase?

2019 HOME LOAN PURCHASE CLOSED IN JUST 12 DAYS In this most recent case study we closed this purchase loan in just 12 days!! The loan was submitted on August 28th 2019 and we had closing docs ready on 9/11/2019 We closed this purchase loan in only 10 days! In this recent case study I […]

5 Bonus Treasures for VIP Clients

Every week I work hard to bring you content full of value. I want you to test drive this content once per week. Every Tuesday I release the BEST content for those that are following and keeping up with the Bay Area Real Estate Market. If you hate it please tell me how to improve […]

Bay Area Home Prices Rising Or Falling?

HOME PRICES FALLING OR INCREASING WITH MORTGAGE RATES? Are Bay Area home prices going to continue increasing or will they begin falling in 2017? Today, in this quick video, I wanted to hang out with you for just a few minutes and talk a little bit about the direction of mortgage rates since the election […]

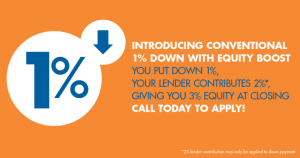

Buying A Bay Area House with A Low Down Payment Loan

Did you know that you can still buy a home with a low down payment mortgage with using as little as 1% of your own money for your down payment? Before the market crashed in 2007 “no down payment loans” were used on almost every transaction when first time home buyers with limited to no […]

BAY AREA REAL ESTATE TRENDS DECEMBER 2015

I was just on the phone with someone who was asking me questions about getting approved and financing Real Estate… He mentioned how he didn’t want to buy now and wanted to wait until Summer next year before getting started… (like a lot of people do) Basically I told him to quit screwing around, put […]