Many people set goals and write them down every year. Not everyone is happy with the results they achieve. This year I’ve decided to share my goal setting method along with my current goals publicly on my blog. There are a few reasons. I like feed back from others that might read them I find […]

BAY AREA REAL ESTATE TRENDS DECEMBER 2015

I was just on the phone with someone who was asking me questions about getting approved and financing Real Estate… He mentioned how he didn’t want to buy now and wanted to wait until Summer next year before getting started… (like a lot of people do) Basically I told him to quit screwing around, put […]

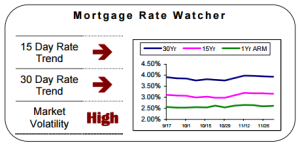

DECEMBER 2015 MORTGAGE RATE WATCHING

UPDATE: yup they finally did it… the FED raised rates. The Federal Reserve did it — raised the target federal funds rate a quarter point, its first boost in nearly a decade. That does not, however, mean that the average rate on the 30-year fixed mortgage will be a quarter point higher when we all […]

HAVE YOU EVER SEEN A MISSHAPEN CLOUD?

This message is one of my favorites… not only for sharing a positive message but almost whenever I’m doubting myself or feeling down. It almost always changes my mood. I hope you enjoy it. “You’ve never seen a misshapen cloud… clouds don’t make mistakes. Did you ever see a badly designed wave? A friend I’m […]

BIG CHANGES TO FHA HUD LOANS SEPTEMPER 15th 2015

If you or a family member are in the process of trying to buy a home, then you should know that new changes to FHA Loan Guidelines may drastically affect the ability of new home buyers to qualify for a home loan. You need to know this if you have student loans or plan to […]

WEEKLY WRAP UP: VOLATILITY OR OPPORTUNITY?

Are we getting ready for a shift in the general direction of the housing market? I send my letter out once per week and I will give you a copy of Think and Grow Rich along with my very own Business start up eBook “Only If you Hustle” when you sign up. You can cancel […]

LOWER OR REMOVE MORTGAGE INSURANCE ON MY FHA LOAN

If you recently bought real estate or own a home and you use an FHA mortgage in order to purchase in the year 2014 he would do yourself a favor by looking into the FHA streamline refinance. MORTGAGE INSURANCE LOWERED ON FHA If you recently bought a home using HUDs FHA loan than you may […]

VIDEO: MORTGAGE RATE FORECAST JUNE 2015

I’ve been getting some great feedback from recent market updates I’ve been doing on YouTube and mailing out to my list. Here is an example of my most recent Weekly Wrap Up. Those of you that have been responding personally via email or with a phone call or signing up for our most recent classes […]

Bay Area Home Loan Closing Costs Estimates & Calculator

Clients who are looking to buy Real Estate in Bay Area cities like Pleasant Hill, Martinez, Walnut Creek and Lafayette who come to me often ask me about closing costs and how to explain them. To answer your questions: Closing costs can be taken care of in three ways in most cases. Buyer pays all […]

JUMBO PURCHASE LOANS UP TO 90% LTV PURCHASE 10% DOWN NO MORTGAGE INSURANCE

Here are some of the main point and highlights for our Jumbo purchase loans up to 90% loan to value ratio (90% LTV) or as little as just 10% down payment on your purchase. If you are looking to make a large Real Estate Purchase in the East Bay area in a city like […]

Can you Get a Jumbo Loan After a Foreclosure Short Sale or Bankruptcy?

“Can you get a jumbo loan after a foreclosure short sale or bankruptcy?” This is a question that I am asked on a regular basis from all kinds of consumers that suffered from a recent housing event like a foreclosure, short sale or bankruptcy since the housing crash and foreclosure crisis that occurred nationwide in […]

FHA MORTGAGE LOAN RULES – INSURANCE RATE LOWERED

FHA mortgage loan rules in the bay area have recently changed. I thought you would be interested to know about this if you haven’t heard yet. This could be good for any FHA buyers that are on the fence and save them some money. You can learn more about FHA guidelines and rules here. However […]

MORTGAGE RATE LOCK RECOMENDATIONS DECEMBER 5TH 2014

If I were considering financing/refinancing a home, I would…. Lock if my closing was taking place within 7 days… Lock if my closing was taking place between 8 and 20 days… Lock if my closing was taking place between 21 and 60 days… Lock if my closing was taking place over 60 days from now… […]

AUDIO: HOW TO OPERATE AT PEAK ENERGY LEVELS

PODCAST: AUDIO INTRODUCTION Yuri is a holistic nutritionist and fitness expert most famous for helping people enjoy all day energy and amazing health in a very short period of time without radical diets or gimmicks. He is the Author of the Best-selling book The All Day Energy Diet, which helps busy men and women double their […]

VIDEO TUTORIAL: BAY AREA INTEREST RATE TRENDS TODAY

Bay area interest rate trends can be difficult to predict. When locking in a good rate timing is often the key. This week we are taking a close look at some of the technical aspects of bay area interest rates. Is now a good time to lock in your interest rate for a refinance or […]

JASON WHEELER’S WEEKLY WRAP UP 10-9-2014

GET MY NEWSLETTER IN YOUR EMAIL EVERY WEEK HERE. I send my letter out once per week and I will give you a copy of Think and Grow Rich along with my very own Business start up eBook “Only If you Hustle” when you sign up. You can cancel anytime. WEEKLY WRAP UP Once a […]

GETTING THE BEST MORTGAGE RATE ON A HOME LOAN

When you’re in the market shopping and out for getting the best mortgage rates on a home loan there obviously several things to consider. Working with a broker or bank? What company to choose? Should you work with the big bank or a small bank? All of these things factor into your experience and results […]

REAL ESTATE PROPERTY REPORT: CALIFORNIA EAST BAY AREA

Obviously the Bay Area Real Estate market has been very hot and we’ve seen some massive appreciation in the last two years or so since the 2012 summer. The question is will the appreciation continue or are buyers better off waiting for the Bay Area Real Estate priced to drop. If you are looking to […]

FIX AND FLIP LOANS BASED ON AFTER REPAIRED VALUE

LENDING TERMS FOR FIX AND FLIP INVESTORS IN THE BAY AREA Fix and Flip loans for investors based on after repaired value (ARV)? This unique loan program allows investors to secure financing based on the “After Repaired Value” of a home with very low interest only payments. Basically we will lend up front on the […]

HOME LOAN 1 DAY AFTER SHORT SALE, FORECLOSURE OR BK?

YES we can get you a loan to purchase real estate right after a short sale or foreclosure. This is offered through a private money financial institution that we have a special relationship with. We are actively helping people with a recent housing event get back into the housing market. Private money is a commonly […]