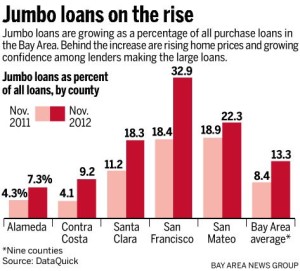

Jumbo mortgage loans for Walnut Creek CA homes can be hard to get approved for if you aren’t working with a Loan Officer or Mortgage Broker that knows exactly how to structure your loan. Most consumers applying for these large Jumbo Loans in the Walnut Creek area have complicated tax returns with K-1s and many […]

Walnut Creek Jumbo Loans: What is the Lowest Rate Today and What Exactly is a Jumbo Loan?

Bay Area Mortgage Rates Today – Rates Rise After Fiscal Cliff Deal

Current mortgage rates in the SF Bay Area sky rocket in the New Year after “Fiscal Cliff” deal gets pushed through in Congress. It’s very difficult to gauge the long term direction of the market place but over the last few years I’ve gotten really good at predicating “short term mortgage rate trends” I […]

Todays Best Mortgage Rates: Current Trends, Charts and Calculators Explained by Jason Wheeler Bay Area Mortgage Broker

Todays current mortgage rates in the California Bay Area are trending upwards this week from the previous week. In this quick video I will show you how you can follow the mortgage rate market and indicate good timing for locking in a loan if you are shopping for real estate or in the middle of […]

VIDEO TRAINING: BEST BAY AREA MORTGAGE RATES

Check out this video training where I demonstrate side by side in real time against my stiffest competition. I will almost always out price my competitors on any given day. I CHALLENGE YOU TO FIND BETTER APPLES TO APPLES PRICING! I’ve been a bay area mortgage broker since 2003 Although it seems you always hear […]

Bay Area Mortgage Broker Talks About Today’s Rate Trends After Hurricane Sandy

Mortgage backed securities tanked the first day the money markets were open after Hurricane Sandy however bay area mortgage rates remain steady and mostly unchanged. After two days with the markets being closed due to the horrible storm on the east coast the Bay Area Mortgage Rates open a bit lower than they were […]

Bay Area Mortgage Rates Still at All Time Lows Is it Time to Refinance?

Bay Area mortgage rates really are at an all time low according to ABC 7 and this trend is keeping mortgage brokers all over the bay area plenty busy moving homeowners from their old adjustable rate loans into today’s attractive fixed rates. Many mortgage brokers are experiencing a major refinance boom right here in the […]

Bay Area Mortgage Broker Talks About Rates and Real Estate Trends in the SF Bay Area

Bay area mortgage rates continue to bounce around all time lows and now continues to be an amazing time to buy or refinance your bay area real estate. People often ask me if they should wait or take advantage of what is going on in the marketplace right now… Well it is impossible to tell […]

Loan Fraud: Don’t Do the Crime and you Wont Do any Time

Loan sharks and fraud are pretty much a thing of the past in this industry I would say for the most part. There used to be agents everywhere creating false fraudulent documents but the penalties are just too crazy now. Don’t do the crime and you won’t do the time. This guy is one of […]

GET A BAY AREA HOME LOAN WHEN THE PROPERTY IS AN INVESTOR FLIP

How can you get a mortgage in the CA Bay Area when the subject property is an investor flip? It was pretty exciting to go into the Labor Day holiday this week knowing my amazing clients who found me on the popular site Yelp.com from the great reviews on the site a few months back […]

Using Assets as Income to Qualify For a California Mortgage Loan

Asset based lending in CA Bay Area Cities like Walnut Creek, Lafayette, Orinda and Pleasant Hill is alive and well. Did you know that if you have a large amount for liquid assets in a mutual fund or stock account, but you are having trouble documenting income as defined by the IRS on your […]