If you are looking for the best Concord Mortgage Broker… Somebody to help you finance your purchase and get you pr-eapproved for a home loan, there are a few things you should learn and consider before you contact anyone.

Concord Mortgage Broker or Banker?

The difference between a broker and a banker can be like night and day. The main difference is that most mortgage bankers work as an employee they get paid a salary and they are normally most concerned with keeping their job and performing well for the bank they work for.

I always recommend speaking with a season licensed mortgage broker who works with several different banks and lenders.

The good mortgage broker should be able to take your specific loan scenario and bring it to over 30 different lenders to compete for your business. The broker is normally paid a flat commission amount by the bank that he takes the loan to regardless of which bank he goes to. Since the broker does not make anymore or any less money he should be able to impartially shop all of the banks that he works with closely ultimately finding you the best deal.

The good mortgage broker will answer all of your most common questions and also give you access to his cell phone. He will likely be on call for you on weekends while you were deep in the process. Banks are typically only working from 9 to 5.

What type of home loans are there for Concord?

A good mortgage broker in Concord will have plenty of options for you to choose from and help you decide and show you which loan program will benefit you most.

As one of the largest brokerage firms in California with over 500 independent agents throughout the state we work with over 80 different wholesale lenders to get you the best deal possible.

HERE ARE A FEW OF THE LOAN PROGRAMS THAT ARE AVAILABLE TODAY

Should I talk to a Concord Realtor First?

Most people that are getting started 10 to work reach out to a realtor first. Almost every single time the realtor will refer you directly to a mortgage person to get pre-approved before they will actually spend time talking with you.

Ultimately it would be in your best interest to get pre-approved with a Mortgage Broker before interviewing real estate agents, if you want to truly have a productive conversation with them.

What will I need it in order to qualify?

INITIAL ITEMS NEEDED TO EVALUATE YOUR FILE:

- 2 years most recent W2 all borrowers

- If self-employed full 1040s tax returns all pages last 2 years.

- Date of birth for all borrowers

- 2-year history of employment (Company name, address, position you held, hire and departure dates.)

- 2 year living history, addresses, rents paid, dates you moved in and departed.

- Most recent 30 days of pay stubs

- Primary Bank Statements all pages 2 months

- Retirement Account Statements, 401K, SEP‐IRA if applicable.

- Do you owe money to the IRS or are your federal tax returns currently extended?

- Do you have a short sale or bankruptcy? If YES I will need the address of the subject property or discharge date of the Bankruptcy.

- Recent Statement from source of down payment or funds for closing.

- Are you a Veteran?

Once reviewed, we can get your application going and let you know about best pricing options given your credit situation.

Concord Home Buyer Common Problems

Some of the most common mistakes that we see people make while processing a home loan are easily preventable as long as you know what to look for.

READ THIS: TO SEE HOW TO AVOID MOST COMMON MISTAKES.

Concord Home Purchase Bottom Line

The bottom line here is… If you are looking for a mortgage broker or real estate agent to help you make your home purchase, we service all the major neighborhoods in Concord CA including Baldwin Park, Buchanan Field, CSU Hayward CCC, Camara, Cambridge Park, Canterbury Village, Clayton Valley, Clayton Valley Center, Clayton Valley Highlands, Colony Park, Concord Naval Weapons Station, Concord Park, Concord Pavilion, Concord Valley, Cowell, Dana Estates, Diablo Creek Golf Course, Ellis Lake, Estates, Four Corners, Meadowhomes, North Concord, San Vicente, Southern Concord, Sun Terrace, Todos Santos, Ygnacio Valley

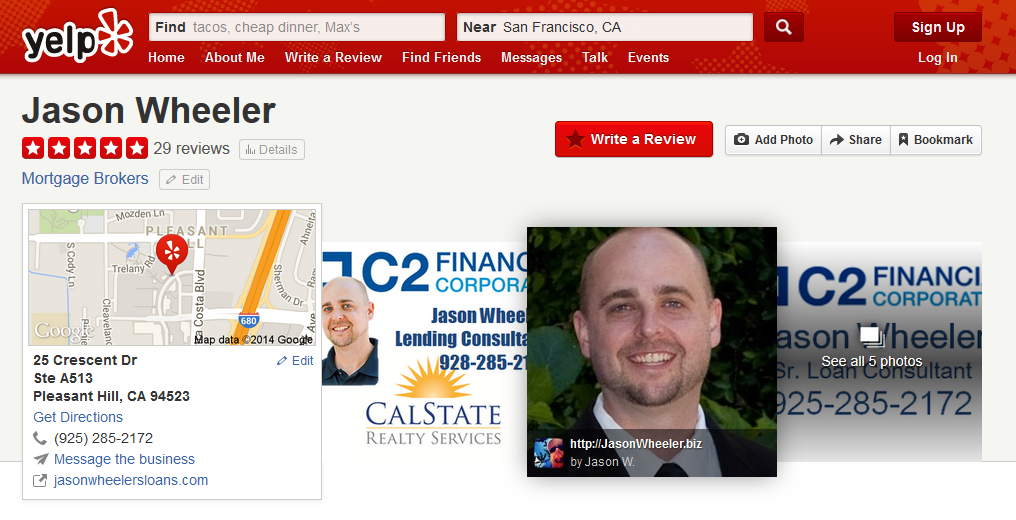

Jason and his team have specialized in helping homeowners in Lafayette specifically, since 2003.

Please contact Jason Wheeler and his team here.

No question is too small when looking to purchase property in Concord. See below where many will testify that Jason Wheeler has built the best Concord CA Mortgage Broker team in the city.