HOW SHELTER IN PLACE IS EFFECTING HOME FINANCING

See in detail how the new 2020 recession is effecting mortgage rates here.

Fannie Mae, Freddie Mac offer help to homeowners in COVID-19 crisis

Two of the country’s best-known mortgage lenders want to help people to keep their homes.

Fannie Mae and Freddie Mac both released statements on Wednesday detailing help they will offer borrowers.

More info from FannieMae and FreddieMac

Disaster relief for FHA homeowners

HUD FORECLOSURE MORATORIUM

The U.S. Department of Housing and Urban Development on Wednesday authorized the Federal Housing Administration to put an immediate moratorium on foreclosures and evictions for the next two months for single-family homeowners who are unable to pay their FHA-backed mortgages amid the coronavirus pandemic.

Critical items to be aware of during this time: Some County Recording Offices Closing Temporarily offering electronic recording.

NOTARIZED SIGNING ISSUES

When buying a home final documents must be notarized and stamped in order to be recorded and finalized. The same applies for final loan documents.

Currently we are running into issues due to the shelter in place and social distancing. Many notaries are not meeting face-to-face with homeowners that need to sign urgently in order to meet lock deadlines and closing deadlines.

Title companies are closed, and most borrowers are not allowing strangers into their homes.

With the few notary signings we have seen this week, many of them scramble to sign in the garage or even on top of car hoods in the front yard. Easy public places like Starbucks or coffee shops are obviously no longer open.

I had one signing where they set up a card table out front of the home.

With a shelter in place order getting stricter and stricter it is getting more difficult to make an appointment to sign final papers.

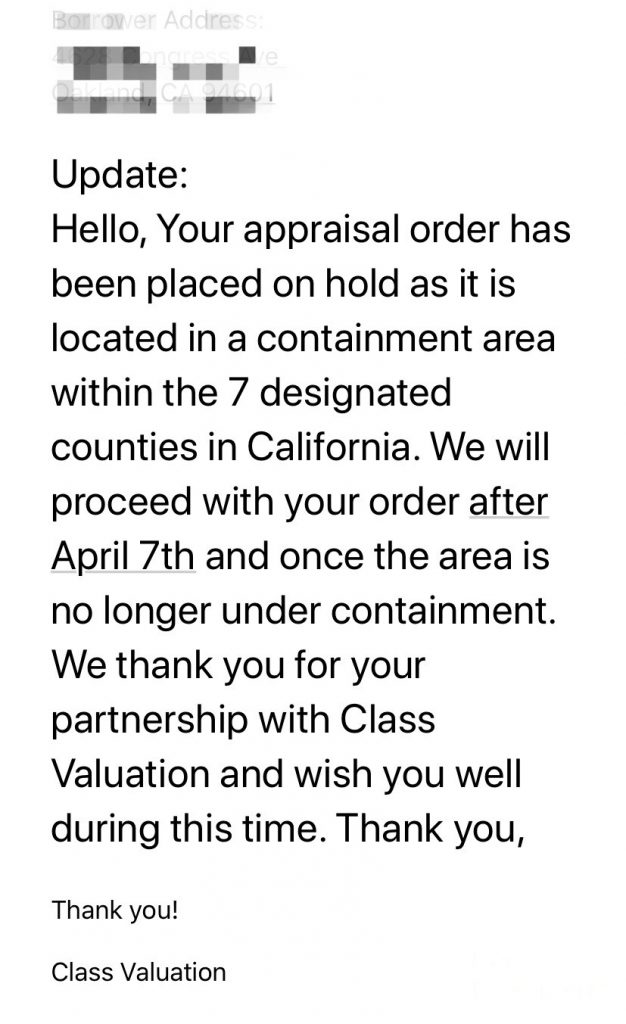

APPRAISAL PROBLEMS

Many appraisal management firms who oversee appraisals for both purchases and refinances have a policy to NOT send appraisers out for new inspection orders in County’s that have an effective SHELTER IN PLACE.

This alone will put a fast halt to just about any refinance or purchase loan that is in process.

Effectively putting the brakes on the entire real estate market… This situation is developing.

WE GOT THE BELOW EMAIL FROM AN APPRAISAL MANAGEMENT COMPANY ON 3/17

Currently we are working on a solution to the appraisal issues. We are working with your lending partners to have Fannie Mae and Freddie Mac issue an emergency approval to allow for VIRTUAL APPRAISALS.

This would be a process that can use technology to get relevant information for the valuation without the appraiser having to physically be present.

UPDATE 3/27 – Currently we are seeing more appraisers accepting appointments and appraising properties.

More to come on this very soon.

RECORDING PROBLEMS

Some county recorder offices may temporarily be closing, but may still be offering electronic recording, so loans in those counties should be OK.

If the country recorder is closed and not offering electronic recording, that will clearly pose some issues.

If a lender cannot record the deed/mortgage, the lender is unlikely to fund the loan.

UPDATE: Many title companies have been able to record electronically and this has not become a huge issue.

(Unless there is some very quick federal or state intervention that would ensure a lender some protection in this case).

This means locks will likely expire and most lenders probably will not be able to indefinitely extend locks.

This means unhappy borrowers and borrower complaints and a hit to every lenders reputation.

It’s like ordering food at a restaurant, knowing there is no one in the kitchen, or there is a staff in the kitchen, but they may go home any minute.

- Lock Periods – Obviously, lenders are buried with refinance volume. Minimum locks should be done for 60 days, but 90 days probably better.

- Lender Delays Due to inability to complete EMPLOYMENT VERIFICATIONS and similar – If the borrower’s employer is closed, lenders may not be able to complete items like VOEs, which could impact closings. Make sure borrowers are aware of the potential for these types of potential issues which are out of our or the lender’s control.

- Mortgage Payments – Stay Current STAY CURRENT on your current mortgage as the closing date of the new refinance is not guaranteed. (They can always get the payment refunded if it was made unnecessarily). If you miss a payment you may not be able to refinance for up to 12 months.

- Multiple Emails/Calls All industry partners, i.e lenders, processors, title, escrow and appraisers, are stretched to the limit. Redundant calls, emails, and texts about the same issue will only cause more email/voicemail traffic and only add to turn times. Clearly, if there’s an urgent issue that you are not hearing back on, a friendly reminder to the person is in order.

We are ready to help… However we can.

Be safe out there, take care of your family, make good decisions that are not driven by fear, and TRY to take a break from the news. 😊

All the best!

Call or text Jason Wheeler 925-285-2172