Due to everything that is going on with the Coronavirus, markets crashing, and overall fast paced changes we’ve been seeing, we wanted to keep you updated as things change and develop in the mortgage markets.

How is lending affected? How will this affect real estate transactions?

Just about EVERY INDUSTRY and every person will be affected one way or another as our daily lives are forced to change. People are adjusting to a new way of working and forced to make changes to remain productive.

We appreciate you staying in touch and hope you find it informative during these trying and unprecedented times.

COVID-19 is projected to be one of the worst pandemics in memory. At this point we will wait and see what happens.

A GLIMMER OF HOPE FOR BAY AREA MORTGAGE CHAOS AMID COVID-19

UPDATE 4/11/2020 – The last few newsletters paint an incredibly interesting and volatile picture for the mortgage market. Just as the industry was coming to terms with unprecedented market volatility due to coronavirus, the details of the CARES Act (the coronavirus rescue/stimulus/relief bill) presented their own set of challenges. For some lenders and borrowers, these challenges are an even bigger deal than the recent market movement.

Read the rest of the article here.

UPDATE 4/7/2020 – some very large real estate companies like Redfin had begun letting off hundreds of agents and much of their staff.

This is an indication that real estate itself will be in for a bumpy ride over the foreseeable future.

UPDATE 3/31/2020 – EXTRA OVERLAYS AND FUNDING DELAYS

Many lenders are placing more overlays and guideline restrictions due to market risk of the masses losing their jobs along with the likely hood of forbearance and missed payments to come. These new overlays and guidelines are expected to change erratically in the coming weeks and could have an impact on current locks and loan approvals.

Some overlay restrictions may include.

- Higher risk based pricing adjustments.

- No more use of rental income without extra reserves due to increased likelihood of missed rental payments.

- Credit scores needed must be higher than before on some programs.

- Bottle necking delays at funding due to lender re verifying employment JUST before sending out funding wires.

FORBEARANCE FREE RIDES?

DO NOT miss a mortgage payment unless you are ready to have financial consequences.

There is a lot of chatter online about a “free ride” or penalty free forbearance on mortgage payments.

Regardless of what you’ve heard or been promised, be prepared to have forbearance missed payments to have serious consequences on availability to qualify for new credit or loans in the future.

We are already seeing borrowers who were promised to skip credit card payments have issues qualifying for new loans afterward due to risk of non payment.

Here is how the SHELTER IN PLACE may effect mortgage closings and home recordings.

2020 Refinance Boom as it’s happening!!

If you are looking to finance a new home purchase or thinking about refinancing current debt you should follow this post.

We will be updating this page as things continue to develop. Please follow along, bookmark and share with anyone that may find it relevant.

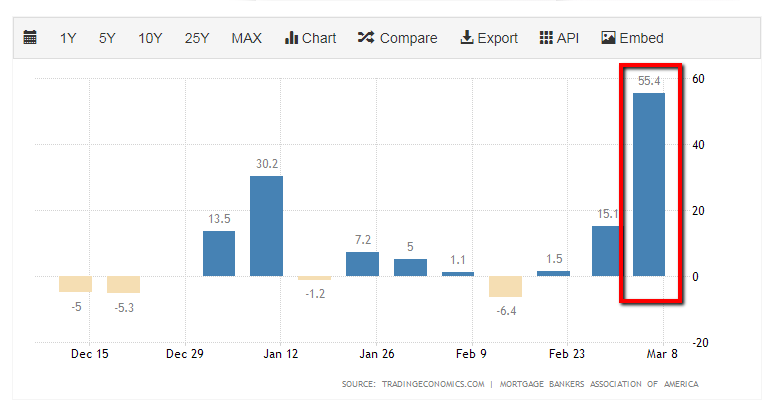

MORTGAGE APPLICATION VOLUME

Bay Area Refinance BOOM 2020!

Early 2020, everyone and their mother is trying to refinance…

January and February 2020 were some of the largest volume months on record due to ALL TIME historically low mortgage interest rates.

We saw a huge boost in refinance volume, submissions and closings.

Over these months of volume lenders began having trouble keeping up with demand and closing loans on time.

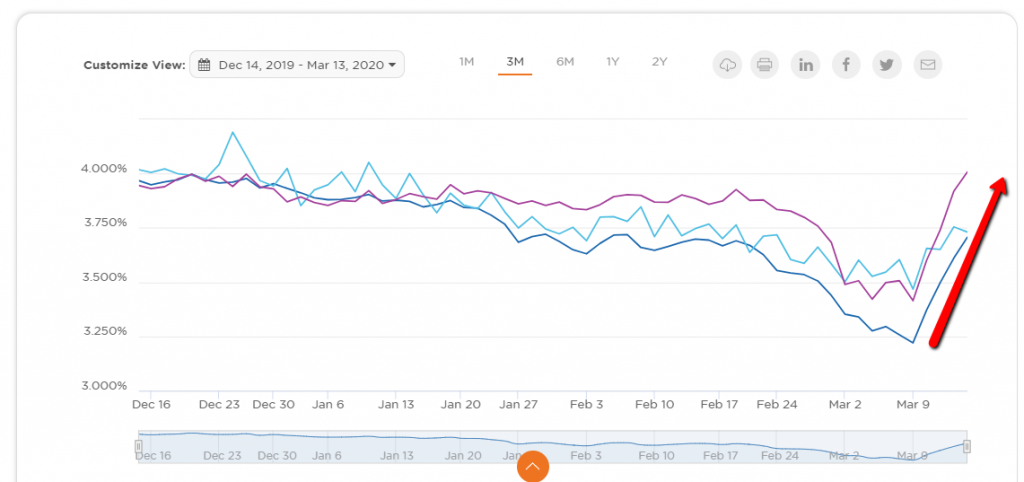

UNICORN RATES… FOR JUST ONE WEEK

3/2/2020 – 3/7/2020 – I’ve been calling this the WEEK OF THE UNICORN MORTGAGE RATE…

This week we see the ALL TIME LOWEST MORTGAGE RATES IN HISTORY… One of the busiest weeks ever in volume for new file intake.

Unfortunately the low low rates were very short lived, and many potential borrowers were not able to lock in on time and left disapointed.

MORTGAGE RATES SKYROCKET

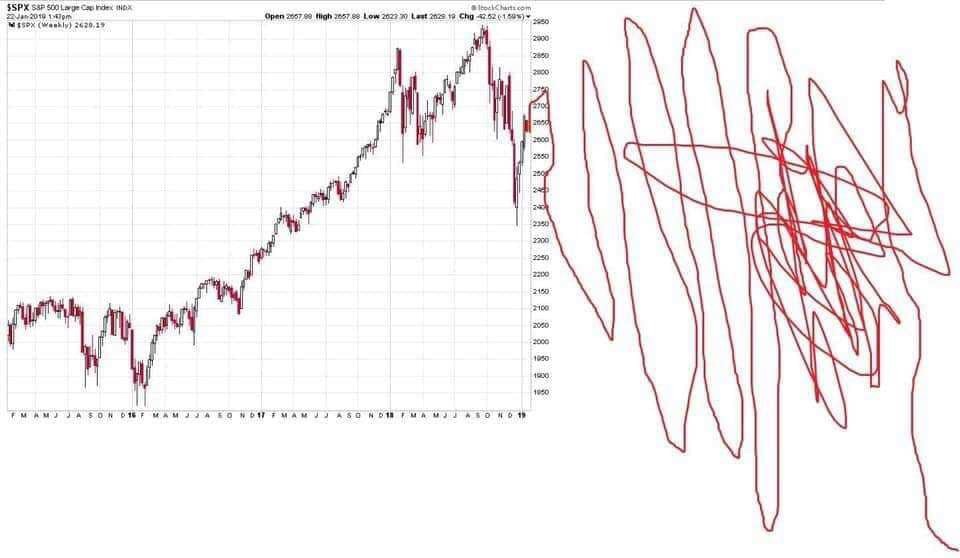

3/9/2020 – 3/13/2020 – Monday morning Market crash and major panic over Coronavirus truly begin to set in… the reality of what is happening begins to take hold on the market place and consumers.

Demand from consumers keeps banks from turning their warehouse lines, and mortgage backed securites begin to skyrocket with the bond market panic, effectively this puts the brakes quickly on the refinance boom.

By the end of the week we had seen one of the largest jumps in mortgage rates ever within a 5 day period.

This week will be known as the wildest week for mortgage rates in history…

With mortgage rates skyrocketing the fastest we’ve ever seen during this week, many consumers looking to refinance, who had gotten quotes the week before, and were unable to lock in on time, are left shell shocked with how much interest rates went up from all time lows (Unicorn Rates) of the previous week.

It’s a lot like when you go to a restaurant that is at full capacity… They can’t get you seated, the kitchen can’t push the food out… ultimately, service and quality suffer and everyone is left angry…

FED LOWERS PRIME RATE IN EMERGENCY CUT ON SUNDAY

3/15/2020 – FED lowers the key interest rate to ALL TIME lows on 3/15 to help cushion the economic blow from coronavirus fallout.

While most consumers believe the FED rate directly effects mortgages it does NOT.

We do hope that the emergency cut will trickle to mortgages soon and pricing will come back down to near all time lows.

Here is what the FED emergency rate cut really means.

To be clear, the Fed fund rate (Prime) being dropped to near zero does NOT mean mortgage rates are anywhere near zero.

They are NOT the same…

The impact of the FED 3/15 decision to lower the FED Fund’s rate (Prime) will impact short term rates, not long term mortgage bonds directly, or fixed mortgage interest rates.

However, the FED did make a quantitative easing play with a plan to buy up $500B in treasuries and $200B in mortgage bonds.

That last part (on mortgage bonds) will help long term mortgage rates, but it will all unfold based on other factors, and will not happen over night.

SHELTER IN PLACE ORDER FIRST WEEK

All businesses are ordered to close down except for essential businesses. Shelter in place ordered.

Monday 3/16 – SHELTER IN PLACE ORDER FIRST WEEK – As expected markets opened Monday and the FED cut DID NOT ease immediate fears in the market.

Dow Jones is down over 12%, mortgage backed securities saw a slight improvement. Despite that, most mortgage lenders were priced worse than closing on Friday.

Friday 3/20/2020 – By the end of the week we see the increased volatility convince many smaller wholesale lenders to discontinue new loan submissions and locked loans.

Many Non QM lenders have also discontinued taking new files in.

Most larger lenders that have full liquidity are still taking new files and approving loans while making moves to assure that they will be able to weather the long term storm.

Pushing new files past initial approval stage to closing becomes a challenge.

This challenges are in part, due to appraisal management companies adhering to shelter in place orders, and effectively not sending appraisers out to inspect homes that need appraisals completed.

UPDATE – many appraisers are now taking appointments again on a case by case basis. Reports are taking a bit longer and some appraisers are charging extra.

However we’ve been able to get back on track somewhat.

Details how things ended up for the week.

Update 3/27 – There’s been no shortage of crazy weeks in the mortgage market lately, and this one was not to be outdone. By the end, the prices of the bonds that normally determine mortgage rates surged well into record highs. That would normally suggest the lowest mortgage rates ever, but the average lender is nowhere close.

In fact, many types of loans moved inexplicably higher in rate. Some variations of certain loan types were completely discontinued or simply priced so poorly that no one would want them. Several lenders stopped taking new applications. Multiple lenders made significant changes to their product offerings. A few lenders closed their doors to new business indefinitely.

WE WILL CONTINUE TO SEE WHAT HAPPENS…

RELATED ARTICLES

The U.S. Department of Homeland Security Cybersecurity and Infrastructure Security Agency (CISA) updated its list of essential services during the coronavirus (COVID-19) crisis and expressly included residential real estate.

LOOKING AT A REFINANCE? HERE’S WHAT’S NEXT:

If you are looking for a refinance to take advantage of lower mortgage rates, then you must be ready to go when the markets begin to reverse course.

- Work with a LOCAL EXPERIENCED loan officer or broker. Big Banks and online lenders that drive “Rockets” will put you in line and treat you like a number on a spreadsheet. Some big banks have over an hour wait time, just to speak with a loan officer.

- Get a full file into your Loan Officer.

- Fill out this online form and

- Gather these documents.

- Upload them here – we will review and advise within 48 hours.

- Once the file is in and reviewed, you should be able to lock your rate at the click of a button once your target pricing hits. RECOMMENDED AT LEAST 45 DAY LOCK FOR REFINANCES DUE TO OVER DEMAND IN THE MARKET PLACE. All banks are working at capacity. A good Loan Officer should be able to monitor the pricing and lock you in when the time is right.

- YOU MAY HAVE TO BE PATIENT WITH YOUR REFINANCE. Loans that may have been closed in 21 to 30 days may take longer due to demand. Mortgage companies are scrambling to meet the demand.

Any questions?!? Ask us about our real estate forecast.

We are ready to help.

Be safe out there, take care of your family, make good decisions that are not driven by fear, and TRY to take a break from the news. 😊

All the best!

Call or text Jason Wheeler 925-285-2172