Mortgage rates are lower than they were at the close last week. Volatility is lower considerably since last week. If you missed the bottom a few weeks ago now may be a good time to take another look at a Cashout Refinance.

-

Right now we are seeing massive volume increases from homeowners looking for cash out refinance us to consolidation home-equity being at a all time high and rates being very very low are driving this activity.

-

Home prices have leveled out listings are taking a bit longer to sell and we’re seeing more and more price reductions but the sellers not quite getting their pie in the sky price that they were hoping for.

-

We are seeing far fewer applications for home purchases as we run into the fall months there are less and less buyers actively looking in the market.

If you were looking to buy this could be a great time for you as there is much less competition in the marketplace and sellers generally are more and more motivated in the later months of the year.

Bay Area Mortgage Market

As of Thursday, most major news outlets and even several important trade organizations ran headlines claiming mortgage rates were flat this week. But rates are actually much lower compared to last week. What’s up with that?

A recent string of disappointing economic data has caused stocks to plummet and bond yields to drop. When yields drop, mortgage rates generally improve.

The labor market, on track to add about 1.9 million jobs this year, could be faltering. It’s the smallest jobs gain since 2010 and down 2.7 million from 2018.

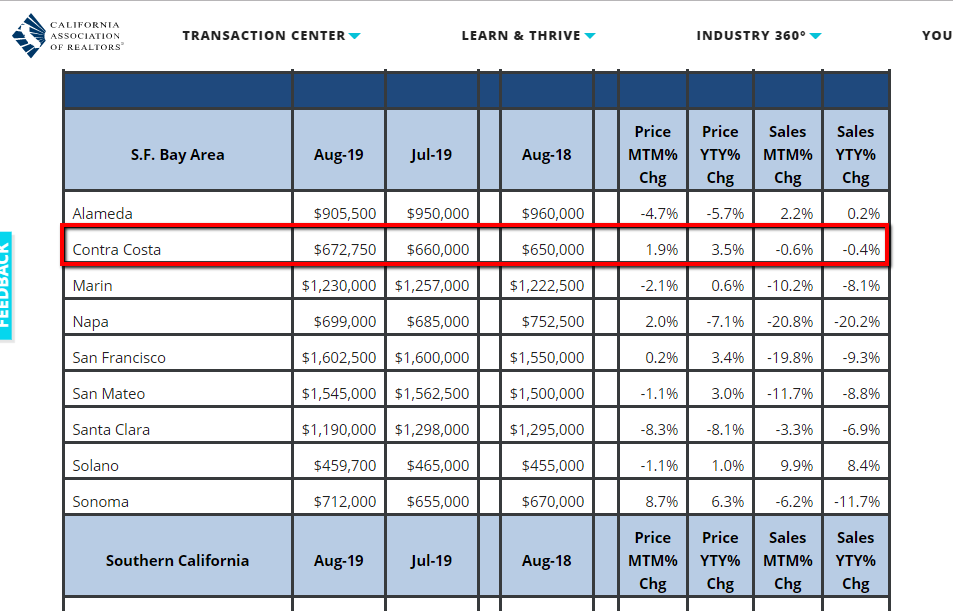

Bay Area Housing Markets

Markets are now pricing in an October Fed policy rate cut, the 3rd in as many months. This speculation is helping mortgage rates improve.

The housing market may be a bright spot in a worrisome economy. The forecast for home sales is good due to rising demand and a projected uptick in inventory.

Single-level homes are making a comeback. One-story homes comprised 47% of new home construction in 2018, up from 45% in 2017. Here is the current inventory you can search.

Fannie Mae and Freddie Mac will be allowed to keep more earnings, a total of $45 billion moving forward, as an initial step toward exiting government control.

[SLIDES] California Association of Realtors Report

16 DIYs That Failed So Badly, They’re Actually Impressive

I like to include something funny for you too. Real Estate and Mortgages can get kind of boring. I try not to take things too seriously.

In the world of home repair and remodeling people do the best that they can. They pour what money they have available to add value and character to their beloved estates. Then there are these folks who can’t be bothered with things like, you know, instructions, skill, patience…

This list is hilarious… the first one looks like something I may have done in college.

View this post on Instagram

Thank you for staying in touch with me and reading my thoughts and commentary.

If you find it helpful or insightful please continue to follow and or share it out to those who may think it’s useful.

Jason Wheeler