Mortgage insurance and the different types of requirements for the different policy options can prompt a lot of questions for potential home buyers.

When you learn you need mortgage insurance it can be discouraging since it will often add to your over all costs for closing.

In a nutshell… If you are purchasing a home with less than 20% down payment you are required to carry mortgage insurance on most loans. (VA loans and some other private loans excluded)

How Does MI Work for Bay Area Loans?

FIND MORTGAGE INSURANCE CALCULATOR BELOW THIS POST

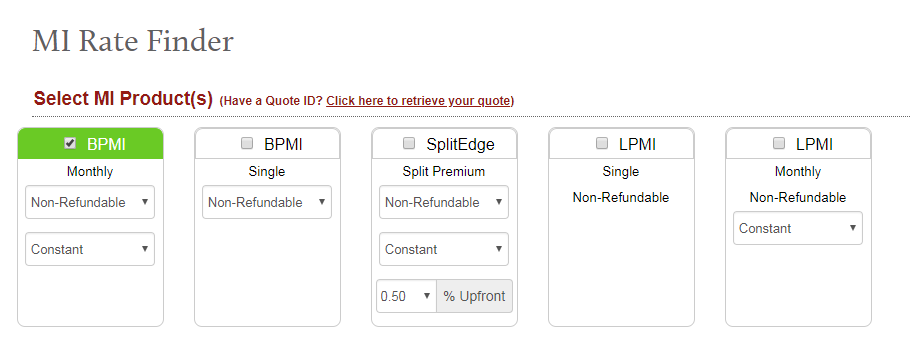

Basic MI (Mortgage Insurance) offers a variety of payment options for many types of mortgage loans. Your lending professional can help you choose the plan that best suits your loan type, financial goals, and budget.

Your lender obtains mortgage insurance by applying to the MI company and supplying all the necessary information. As a borrower, you provide nothing extra and there are no additional forms for you to complete or fees to apply for mortgage insurance coverage.

Mortgage insurance 101

There are two main ways of paying for mortgage insurance: borrower-paid MI and lender-paid MI.

Borrower-Paid Mortgage Insurance (BPMI)

Using borrower-paid MI, you pay the mortgage insurance premium to your lender, and your lender then pays the MI company.

Borrowers may be required to pay either a recurring monthly MI payment or a single lump sum (typically paid at closing) that provides coverage to your lender for as long as you have the loan.

Borrower-Paid Monthly Premium

If you want to keep your closing costs low, consider MI with a premium that you pay each month along with your mortgage.

You typically need only one to three months’ premium at closing, but that’s far less than a 20 percent down payment.

The upside to a monthly premium is that it’s convenient and the MI can be cancelled when you no longer need it. You can request cancellation once the principal balance of your loan reaches 80 percent of the original value of the property, or it will be cancelled automatically when the principal balance of your loan reaches 78 percent of the original value of the property. You may reach the cancellation thresholds more quickly if you make larger mortgage payments than required.

The downside: It may be more expensive in the long term than other payment options.

Borrower-Paid Single Premium

A single premium can be paid in cash at closing or financed as part of the mortgage loan. It can be paid by the borrower, lender, agent, builder, or seller. (Lenders will also consider gifts and grants that provide funds for up to 100 percent of the down payment if certain requirements are met.1)

This option may be the least expensive in the long term. And if you refinance or move before you’ve paid off your loan, you may be eligible for a refund of part of the payment if you choose an MI single-premium product with a refundable option.

It may require more funds at closing than other payment options.

A great online calculator to get a basic idea of which policy may be best for you can be found here.

Leave Me a Quick Comment or Note