Paying a mortgage can feel like a trap sometimes!

It feels like mortgage companies are sticking it to you right?

Whether you recently bought a home two or three years ago, or if you’ve been paying on your current mortgage for several years there’s one thing that is certain.

Mortgage servicer’s are interested in one thing, squeezing the absolute most money out of you as possible.

Although the mortgage companies truly want the most money they can get from the borrowers they lend to, there are several ways to structure your mortgage so that it was the greatest advantage to you the borrower.

NEWSFLASH: The loan that you used to purchase your home may not be the best fit given your current situation.

There are a lot of reasons you may want to take a close look at refinancing your current mortgage, or taking cash out, and since there are only a few ways to accelerate the payoff of your loan effectively, we normally recommend taking a close look at how a refinance might benefit you at least once per year.

If you have an interest rate .25% above the current average.

The primary reason many homeowners refinance their mortgage is to lower their interest rate. It’s why we refinance just about any loan, whether it’s a mortgage, student loan, or even credit card debt (think 0% balance transfer cards).

As you evaluate whether lower rates justify refinancing, consider the following:

1. How much will my monthly payment go down?

2. Are there any costs associated with the refinance?

3. How much interest will I save over the life of the loan?

4. Will a refinance extend the term of my loan?

All of these calculations can be done very easily with a quick look at your current mortgage along with a good value estimate of your home.

If you may be in a position to switch from a 30 to a 15 year fixed

Maybe that 30 year fixed is taking too long and you’d like to lower your rate even more and accelerate your mortgage payoff?

The main question may be Affordability

The first thing to look at is the difference in monthly payments between a 15-year mortgage and a 30-year loan of the same size, you want to look at what that 15-year payment will be and decide if you can swing it. If you can’t, that will decide it.

Fifteen-year mortgages do charge lower interest rates than 30-year loans but carry higher monthly payments because you have to pay all principal back in half the time.

If you have other consumer debt (auto payments, credit card/s, student loan/s, etc)

Consumer debt can be tough to pay off. Often the rates are considerably higher than the most recent mortgage rates and I’ve seen some consumers with credit card debt that was charging over 20% interest!!

If you have other consumer debt you may want to look at what that debt is cost you in the long run.

If you have a desire to make home improvements and need money.

In most cases the cheapest money you are able to access is equity in your home for two reason

1. Mortgage rates are normally much lower than other unsecured debt

2. Mortgage interest is often tax deductible (check with your CPA)

3. Payment are often amortized over 30 years

CASE STUDY: Recently I got back in touch with somebody who I had helped finance the purchase of their current home. Since she had purchased the home, values have gone up significantly and she had added solar panels to her home for a considerable monthly payment.

When I ran some numbers by her we realized she was able to pay off her solar panel debt, along with several credit cards and other consumer debt that she was having trouble paying off.

Because interest rates are so much lower than when she purchased and her home value had grown, she was very surprised to learn that we were able to refinance her current mortgage along with all of her consumer debt all while keeping her monthly payment just about the same as what she was used to. Ultimately she was saving hundreds of dollars per month by consolidating her consumer debt.

If you have an ARM (adjustable rate mortgage)

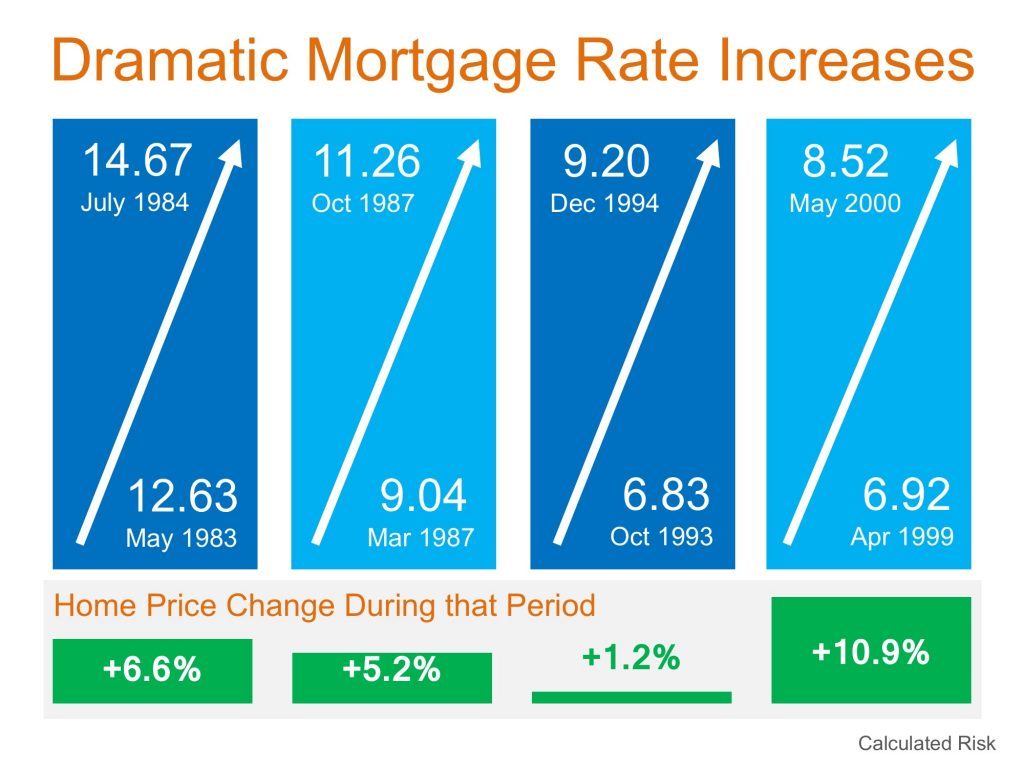

Adjustable mortgages were great in the early 2000s rate were really low and even when these adjustable mortgages would change they would often move downward and many homeowners LOVED them. The difference is that the forecast for interest rates to stay as low as they’ve been is very unlikely.

The FED has increase rates several times since 2016 and all indications are that that trend will continue. If you are in an adjustable when rates go up it’s possible you could be in for a world of hurt and risk your payment

going up.

Here is what a recent client had to say about her tough lending situation

If you are paying PMI (private mortgage insurance), reach out.

Many homeowners took advantage of the low housing prices from 2009 to 2013 or so and bought a home with very little down payment. In this situation it is very likely that you are either:

1. Paying monthly PMI (Private Mortgage Insurance)

2. Or you took a higher than normal interest for LPMI (Lender Paid

Mortgage Insurance)

Here’s the thing… Low down payment loans are great for helping first time home buyers who struggle to come up with the traditional 20% down payment. The problem is is that private mortgage insurance is a complete waste of money.

It would be in your best interest as a homeowner to eliminate private mortgage insurance as soon as you are allowed to.

Will a refinance benefit you and your unique situation?

If you can say YES to any of the main reasons I talk about above or if you have a specific question or unique scenario you owe it to yourself to take a look and let us crunch the numbers to see if a refinance will benefit you.

LOOKING AT A REFINANCE? HERE’S WHAT’S NEXT:

If you are looking for a refinance to take advantage of lower mortgage rates, then you must be ready to go when the markets begin to reverse course.

- Work with a LOCAL EXPERIENCED loan officer or broker. Big Banks and online lenders that drive “Rockets” will put you in line and treat you like a number on a spreadsheet. Some big banks have over an hour wait time, just to speak with a loan officer.

- Get a full file into your Loan Officer.

- Fill out this online form and

- Gather these documents.

- Upload them here – we will review and advise within 48 hours.

- Once the file is in and reviewed, you should be able to lock your rate at the click of a button once your target pricing hits. RECOMMENDED AT LEAST 45 DAY LOCK FOR REFINANCES DUE TO OVER DEMAND IN THE MARKET PLACE. All banks are working at capacity. A good Loan Officer should be able to monitor the pricing and lock you in when the time is right.

- YOU MAY HAVE TO BE PATIENT WITH YOUR REFINANCE. Loans that may have been closed in 21 to 30 days may take longer due to demand. Mortgage companies are scrambling to meet the demand.

Leave Me a Quick Comment or Note