HOME PRICES FALLING OR INCREASING WITH MORTGAGE RATES?

Are Bay Area home prices going to continue increasing or will they begin falling in 2017? Today, in this quick video, I wanted to hang out with you for just a few minutes and talk a little bit about the direction of mortgage rates since the election of Donald Trump, and how they may likely impact Diablo Valley Bay Area real estate home prices.

If you look at some of the charts that I reference to in this quick video you will see interest rates have been spiking ever since the election.

If you ask me… the days of mortgage bonds being at their lowest are behind us. Most prominent financial planners/annalists I’ve spoken with recently agree that we will likely NEVER see bonds and mortgage rates this low again in our lifetime.

READ HERE IS WHY MORTGAGE RATES ARE INCREASING

The 3.5% interest rate on a 30 year fixed mortgage will likely not be seen for a long time to come, if ever again. Only time will tell how the new policies will affect the economy after eight years under Obama.

Contrary to what you might believe, higher interest rates may not be such a horrible thing for buyers.

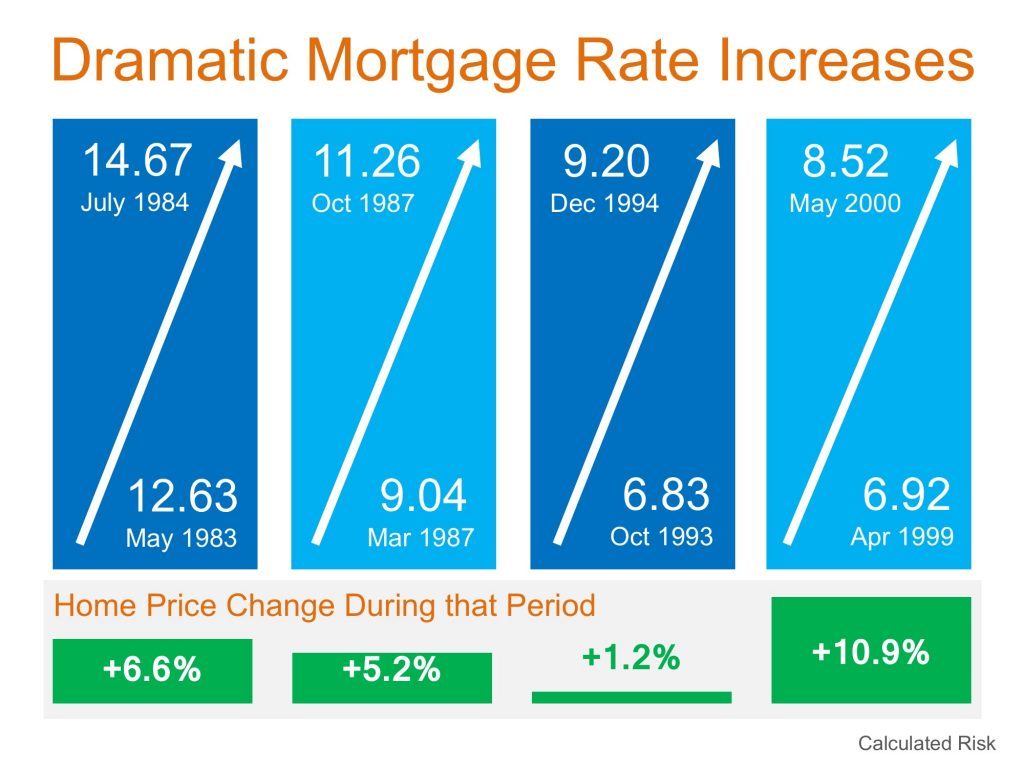

One of the most common questions that many people are asking me since the election, is how I think the new trend in interest rates will impact Bay Area home prices. In this video I go over a few examples, as well as case studies from past interest rate hikes, and how those past increases affected real estate prices throughout the nation.

HOW PAST RATE HIKES DISRUPTED REAL ESTATE PRICES

Many people that I speak with believe that higher interest rates, which will obviously translate to less buying power in general for borrowers seeking to obtain a mortgage, will cause home price depression and a possible shift to a buyers market. Keep in mind, there are many other factors that will play into this aside from simple 30 year fixed mortgage rates.

This assumption seems to make sense… and I’m not saying I completely disagree with it. However if you look at many incidents in the past, you will see that since the early 1980s most of the largest interest rate hikes that occured actually ended up translating to hire home price that year.

READ: Will Increasing Mortgage Rates Impact Home Prices?

I normally advise people that just about anytime is a good time to buy real estate, provided the reason that you’re buying it is a good one, and provided that you could afford the mortgage payments without stretching yourself too much financially.

It’s never a good idea to own a home, if your payments are so high that you can’t enjoy your life, right?

More important than the direction of real estate prices… whether they are increasing or falling, is the overall list of benefits for your individual situation when or if you decide to buy. Some of these benefits include whether or not it is cheaper to own or rent, and potential appreciation among many other potential reasons.

If you are considering the possibility of buying or selling within the next six months you need to download this 22 page guide.

Regardless of the direction of the market, increasing or falling, owning in the bay area is a great idea.

Leave Me a Quick Comment or Note