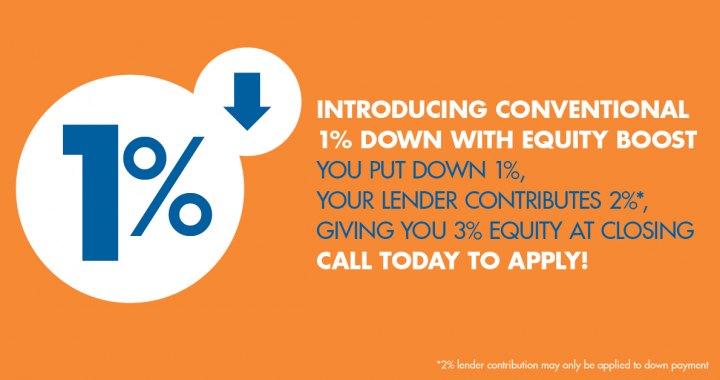

Did you know that you can still buy a home with a low down payment mortgage with using as little as 1% of your own money for your down payment?

Before the market crashed in 2007 “no down payment loans” were used on almost every transaction when first time home buyers with limited to no savings were jumping in the market place. This along with several other factors helped contribute to the real estate market crash that began the recession in the late 2000s.

The cool thing is that getting a low down payment mortgage to buy your house is back, and accessible for the right home buyers on conventional loans in 2016.

Now these special loans are not available at every bank… As I’m writing this you won’t find them at banks like Wells Fargo or Bank of America. I’m not sure if big main stream banks will roll these types of loans out later on in order to give more potential buyers more options for purchasing a home later or not.

Lenders aren’t just giving money away to just anyone the way they used to before the market crash… however getting a 1% down payment loan is pretty easy for the right borrower that can qualify and afford the monthly payments while showing a solid work and credit history.

HOW THE LOW DOWN PAYMENT MORTGAGE WORKS

Buyer puts down 1%

Lender contributes 2%*, giving them 3% equity at closing

700+ FICO, 43% max monthly debt to income ratios allowed

Great competitive low rates

Available with no monthly Mortgage Insurance

*2% lender contribution may only be applied to down payment

There are caps on income requirements that will allow a borrower to qualify for this loan. Generally if you are making less than $100,000 per year you may qualify for this low down payment option.

REASONS YOU WOULD WANT TO GET A LOW DOWN PAYMENT MORTGAGE

The low down payment 1% loan option is much different than the stated income ninja loans of the past.

A borrower must fully demonstrate that they have the ability to make the payments based on their debt to income calculation. It’s likely that you won’t see your part-time burger flipper and the person who works for cash under the table qualifying for this program.

Pros and Cons of Low Down Payment Loans

The biggest perk to a low down payment loan option is that it allows otherwise financially strapped borrowers entry into a very competitive real estate market place.

Many borrowers have plenty of monthly cash flow with stable income and solid job history but have been unable to save the kind of capital required for a traditional down payment to purchase a home here in the Bay Area.

For this particular program the buyer is required to fund 1% of the purchase price on the form of a down payment. These funds must be sourced and verified.

The bank will contribute 2% of the purchase price towards the purchase of the home in effect giving the homebuyer and borrow or a 2% equity position at the time of closing.

The 2% lender contribution does not have to be payback and is not secured by a deed of trust is not a loan.

CONs of Low Down Payment Loans

The low down payment option does come with a bit more of a risk to the borrower as far as an equity position goes. With such a low down payment it is more likely with a real estate correction or if prices were to go down that the borrower and home buyer would be subject to being upside down or holding negative equity position on the home.

In recent years since 2011 in the Bay Area Home prices his can of continued and upward trend. It is of course impossible to guarantee that trend will continue for the foreseeable future. And as any home buyer should realize the real estate market does come with implied risks.

The only other con of the low down payment loan option with a 2% equity stake given from the lender is a trade-off for a slightly higher interest-rate than a standard conventional loan. Every loan scenario will priced differently however you can expect your interest-rate to be about an eighth to a quarter higher than a standard conventional loan. Remember that mortgage interest is a tax-deductible for most homeowners however we recommend that you consult your CPA on this to verify.

At the end of the day this one percent down payment loan option is great for home buyers that may have a limited resources when it comes to finding a down payment while still having a solid income decent credit scores and ability to make the monthly payments.

Unlike other low down payment options or government loan programs such as FHA this mortgage option does not come with any large upfront mortgage insurance fees or monthly mortgage mortgage insurance fees.

There are no prepayment penalty’s and you can refinance anytime as long as you qualify for the new financing terms.

Call our Bay Area Mortgage Brokers to get a quote today.

Leave Me a Quick Comment or Note