A lot has changed this month compared to last month in the local real estate market.

Inventory is still very low prompting more competition between buyers. Unexpectedly, interest rates have fallen to near fifty-year lows.

People everywhere are applying for financing and trying to buy home.

NOW IS A GOOD TIME TO GET YOUR FINANCIAL DUCKS IN A ROW

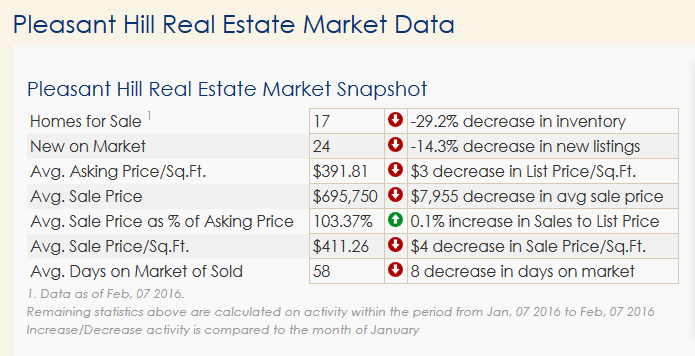

PLEASANT HILL REAL ESTATE MARKET DATA

The Pleasant Hill real estate market specifically has seen a 29% decrease in inventory since this time last month. There are 24 new homes on the market in the average price per square-foot in Pleasant Hill is $391.81.

It’s still taking a bit of time to sell homes in Pleasant Hill average days on market is 58 days

ACTIVE LISTINGS IN PLEASANT HILL

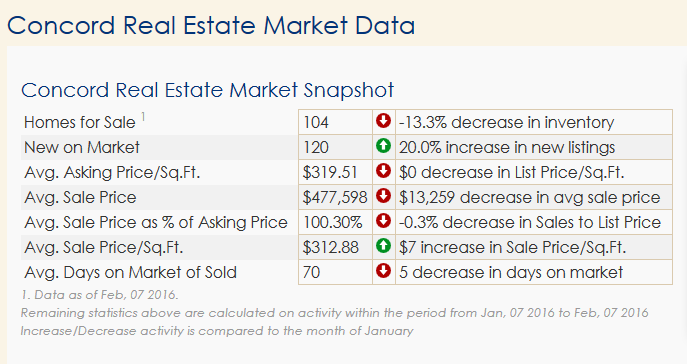

CONCORD REAL ESTATE MARKET DATA

The Concord real estate market specifically has seen a 13% decrease in inventory for the 120 new homes on the market.

Average sales price decreased just a bit and Holmes are taking about 70 days to sell.

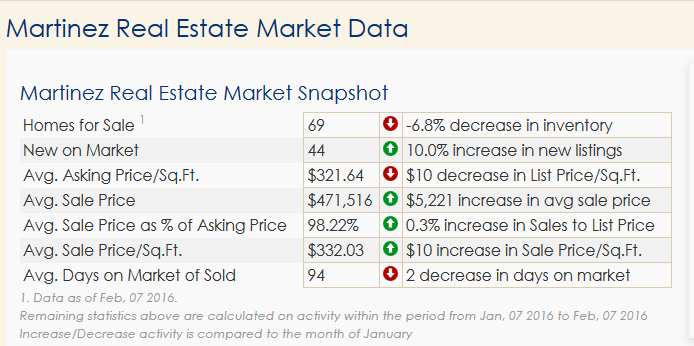

MARTINEZ REAL ESTATE MARKET DATA

Martinez real estate market specifically has seen a smaller decrease in inventory, but it still is in decline.

Their 69 homes for sale in Martinez with 44 new homes to the market. The average days on market in Martinez is currently 94 days.

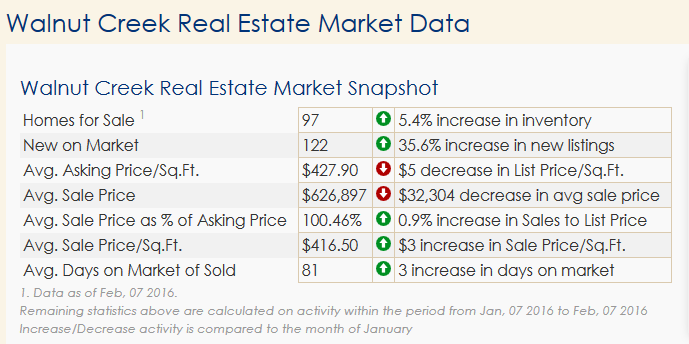

WALNUT CREEK REAL ESTATE MARKET DATA

The Walnut Creek real estate market specifically as seen a small increase in inventory with 97 homes for sale. There are 122 new homes on the market. Average sales price is down just a tad and days on market sold has increased by three days to make it 81 days.

ACTIVE LISTINGS IN WALNUT CREEK

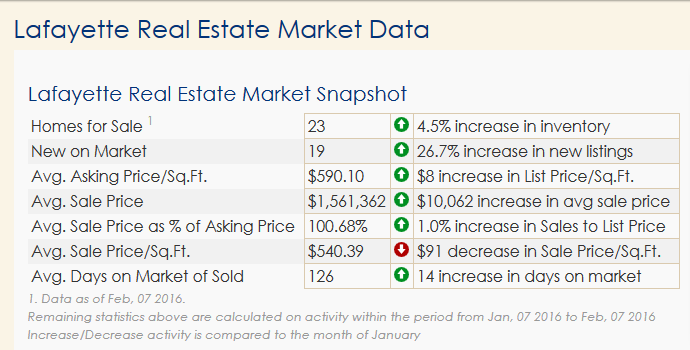

LAFAYETTE REAL ESTATE MARKET DATA

The Lafayette market specifically has seen a very small increase in inventory with 23 homes for sale. Lafayette has 19 listings new to the market in the average asking price per square-foot is $590.10.

MORTGAGE RATE TREND AND LOCK ADVISORY

Float / Lock Recommendation

If I were considering financing/refinancing a home, I would…. Lock if my closing was taking place within 7 days… Lock if my closing was taking place between 8 and 20 days… Lock if my closing was taking place between 21 and 60 days… Lock if my closing was taking place over 60 days from now… This is only my opinion of what I would do if I were financing a home. It is only an opinion and cannot be guaranteed to be in the best interest of all/any other borrowers.

This week brings us the release of only two pieces of monthly economic data that are relevant to mortgage rates in addition to two Treasury auctions and semi-annual congressional Fed testimony. One of the economic reports is considered highly important to the markets, but the other is not likely to be a market mover.

The Fed testimony has a decent probability of causing volatility in the markets and the auctions can lead to intraday changes to rates also.

We’re getting ready to roll into the springtime and typically spring is when you see a lot of new listings with the weather getting nice and buyer start competing harder than ever. If you’re thinking about jumping to the real estate market now would be a great time for the summer rush.

Leave Me a Quick Comment or Note