Do you have a goal setting method that you use on a regular basis in order to plan and attain your goals yearly, quarterly, or monthly?

A couple weeks ago I told you that I was going share my 2016 goals with you. Here they are.

I wanted to share my goals this year for a few reasons. Accountability (I’m more likely to hit them if I know that I told you I would right?) and I also like to get feed back on my goal setting method and also hear about methods that you might use.

If you have a goal setting method that you use on a regular basis that you love I would love for you to just reply to me and let me know about it.

On another note I wanted to go ahead and send you out the latest figures for the East Bay real estate market.

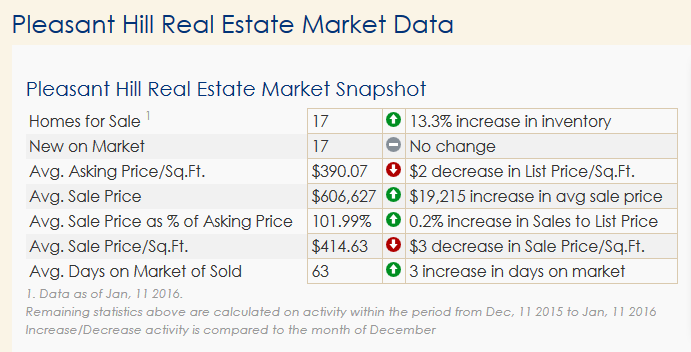

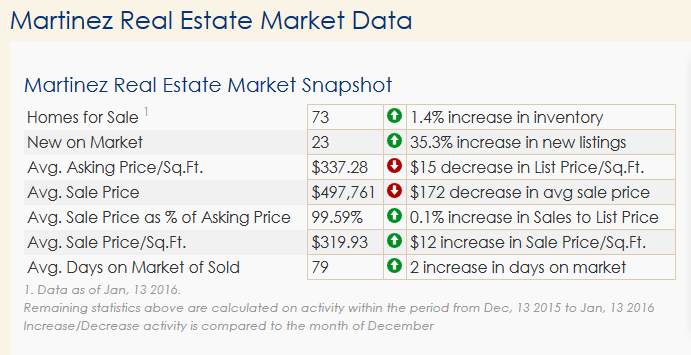

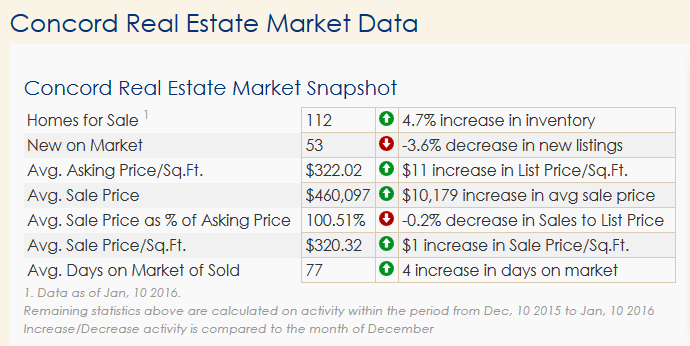

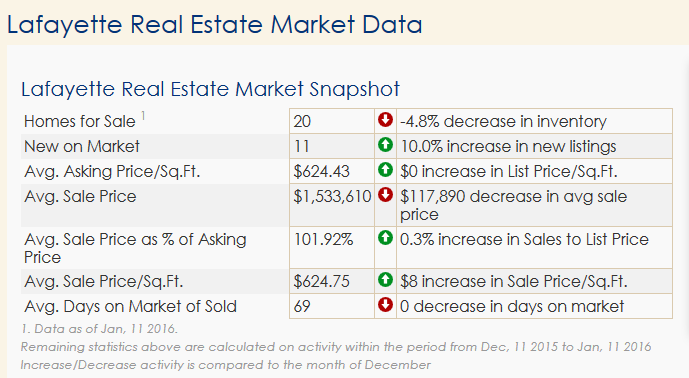

Here’s an update for the main cities that I focus on and work in… Pleasant Hill, Martinez, Concord, Walnut Creek, and Lafayette.

If your city is not listed here and you’d like me to send you figures and stats, please just send me a quick note and ask me about your city. I’ll get the numbers over to you right away.

Here is how the market has changed since this time last month in December 2015.

PLEASANT HILL REAL ESTATE TRENDS

MARTINEZ REAL ESTATE TRENDS

WALNUT CREEK REAL ESTATE TRENDS

CONCORD REAL ESTATE TRENDS REPORT

LAFAYETTE REAL ESTATE MARKET TRENDS

As far as interest rates go…

Things have been pretty crazy. Last month the FED decided to raise the prime rate for the first time in almost 10 years. Many feared that this would have a negative effect on mortgage rates. However, since the beginning of 2016 the stock market has been in a free fall, commodities have been in a free fall, and interest rates have also followed suit falling to the lowest point in months.

Here’s my take on interest rates right now

Float / Lock Recommendation

If I were considering financing/refinancing a home, I would…. Lock if my closing was taking place within 7 days… Lock if my closing was taking place between 8 and 20 days… Float if my closing was taking place between 21 and 60 days… Float if my closing was taking place over 60 days from now… This is only my opinion of what I would do if I were financing a home. It is only an opinion and cannot be guaranteed to be in the best interest of all/any other borrowers.

As if to reiterate that markets will do what markets will do, regardless of what the experts say,

mortgage rates managed to move slightly downward this week, even when employment data came in

better than expected. While the Fed and many experts agree that the US economy has enough wind in its sails to power through the relative softness of our international trading partners, the market has been spooked by data out of China pointing to more challenges ahead for Asian markets.

HERE ARE THE TRENDS IN THE MORTGAGE RATES RECENTLY

US stocks were driven downward further by disappointing readings in both ISM indices. All of this uncertainty sent investors once again scrambling for the relative safety of US bonds and Treasuries. This week’s important economic data comes on Friday, so the beginning of the week may be driven more by discussions of the international economic situation. The more bearish that traders view foreign economies, the more likely that rates are to decline.

However, if Retail Sales and Industrial Production come in on a high note, we could see mortgage rates reverse course and head upward.

Leave Me a Quick Comment or Note