Clients who are looking to buy Real Estate in Bay Area cities like Pleasant Hill, Martinez, Walnut Creek and Lafayette who come to me often ask me about closing costs and how to explain them.

To answer your questions: Closing costs can be taken care of in three ways in most cases.

-

Buyer pays all or partial. This loan is structured so that bank fees are credited by the lender and title escrow taxes and insurance are paid by you as buyer. I can negotiate a higher lender credit to cover more closing costs if you want.

-

Seller pays all or partial – this must be negotiated in your purchase agreement. There is no mention in the contract that the seller is offering a credit toward closing. You can ask your Realtor if you want

-

Lender Pays Closing Costs – In many cases we can negotiate the entire closing be paid for by the lender. Usually the tradeoff is a slightly higher interest rate.

HOME LOAN CLOSING COSTS INDIVIDUALLY EXPLAINED HERE

HERE IS A PDF GUIDE ON WHO PAYS FOR WHAT NORMALLY FROM FIRST AMERICAN TITLE

Closing your home should be exciting, and once you understand the process and how it works, it can be. Here you will find a list of costs commonly associated with closing on a home. Fees may vary depending on where you live, so be sure to talk to your lender, real estate agent, and settlement company for more specific information.

All closing costs must be listed on your closing disclosure settlement form, a document that is required to be filled out prior to finalizing the purchase of your home.

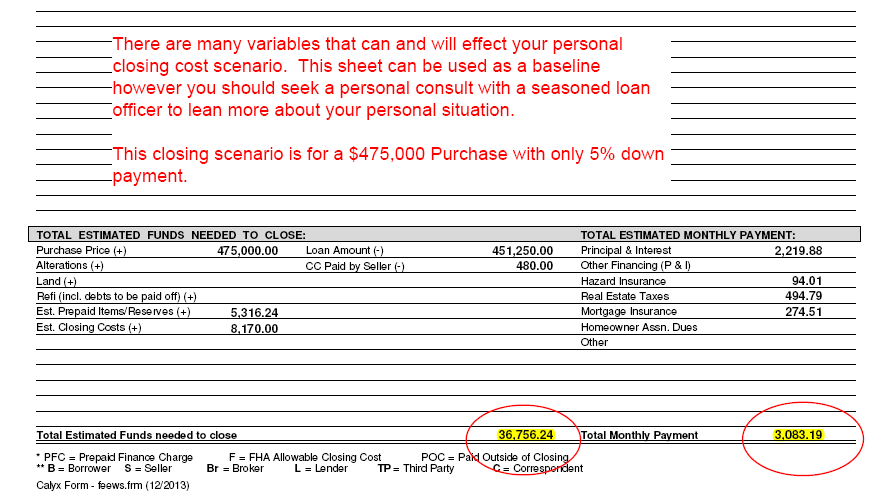

Bay Area Home Loan Closing Sheet Example

Below is an example closing estimate sheet you will likely run into when getting a quote from a loan broker. You can download the full pdf copy of this example scenario by clicking on the image below.

What are My Closing Costs?

What is a title company and what are their fees?

Will I need mortgage insurance?

In addition to the sales price of the home, there are a variety of costs associated with finalizing the transaction. Click on any of these links below for more information on these costs:

Leave Me a Quick Comment or Note