“Can you get a jumbo loan after a foreclosure short sale or bankruptcy?”

This is a question that I am asked on a regular basis from all kinds of consumers that suffered from a recent housing event like a foreclosure, short sale or bankruptcy since the housing crash and foreclosure crisis that occurred nationwide in 2008.

We are a correspondent channel to some of the best portfolio loans available is you recently had a short sale bankruptcy or foreclosure through banks like BANC home loans, Angel Oak and Coastal Lending.

VIDEO: HOW TO GET A JUMBO LOAN AFTER SHORT SALE

RECENT HOUSING EVENT PORTFOLIO LOAN

This is a private portfolio loan that is not offered by most other lenders.

- We offer this program up to 80% LTV or with a 20% down payment.

- Loan amounts from $130,000 to over a million.

- This loan is available immediately after a short sale foreclosure or Bankruptcy

- 3 months reserves are required

- Available on 5/1 7/1 ARMS or 30 Year Fixed

- Liquid Assets can be used for qualifying

- Sorry no gifts for down payment are allowed. Borrower must use their own funds to close with two months seasoning.

Rates change daily so call us or email for a custom quote.

The fact is simple…

If you had a foreclosure or lost your home to a short sale you are definitely NOT in a boat all by yourself.

Until very recently getting a home loan after one of these stressful housing events was almost impossible. Getting a Jumbo Loan to buy real estate was almost unheard of as banks were not willing to take the risk on such a borrower until just recently.

WAIT TIME TO GET A LOAN AFTER A SHORT SALE FORECLOSURE OR BANKRUPTCY 2015 CONVENTIONAL AND FHA RULES

In 2014 there were some rules and guidelines created for wait times after going through one of these financial pitfalls.

UPDATED FEB 2014: Wait times for foreclosures, short sales, bankruptcies (Chapter 7 & 13), loan modifications, and deed in lieu:

Wait Time after Foreclosures ON CONVENTIONAL AND FHA MORTGAGES

-

12 months (FHA Back-to-Work)

-

36 months (FHA, VA, and USDA)

-

36 months (Conventional with extenuating circumstances)

-

84 months (Conventional without extenuating circumstances)

Wait Time after Short Sales:

The minimum wait varies based on the loan-to-value of the new mortgage and if the buyer was delinquent at time of sale.

-

24 months (Conventional with extenuating circumstances)

-

36 months (FHA, USDA, and VA if borrower was delinquent at time of transfer)

-

48 months (Conventional without extenuating circumstances)

These wait time seem quite extensive for Conventional and FHA loans. However we can offer loans up to 2 million with no wait after a short sale with our portfolio lending programs.

HIGHLIGHTS FOR GETTING A JUMBO LOAN AFTER A SHORT SALE

We fund all kinds or portfolio loans that other banks will not even consider. One of the niches that we fill are for the homeowner who recently had a negative housing event such as a short sale foreclosure or bankruptcy.

THE OAK TREE NON PRIME SELECT LOAN OPTIONS

Here are some of the highlights our should know about if you are considering such a loan.

-

The main factor on qualifying is your ability to provide a down payment. There is a minimum of 20% down payment required in order to close on this Jumbo loan after a short sale

-

Loans up to 2 million are allowed

-

Owner occupied 2nd homes and investment properties can qualify

-

Bank statements and assets can be used to support qualifying income

-

Purchase loans, refinanced and cash out loans are qualified.

-

Loans can be qualified as soon as one week after a short sale bankruptcy or foreclosure

-

30 year fixed available non prime select sheet

-

5/1 ARMs available non prime select sheet

-

Interest only available on lower LTV loans.

-

3 months reserves will be required at closing

WHAT KIND OF RATES CAN I GET ON A JUMBO LOAN AFTER A FORECLOSURE?

While it would be impossible to quote a rate since pricing and mortgage rates change on a regular daily basis you might be surprised that the rates on our 2nd chance Jumbo loans are very competitive. There are many factors that can determine the rate that you will be able to secure.

SOME FACTORS THAT WILL EFFECT YOUR LOANS INTEREST RATE ARE:

- How much can you put down or your Loan to Value ratio’

- Credit score

- Are we able to document your income or not?

- Have you re-established new good credit history since your short sale or foreclosure?

- Was the housing event or bankruptcy the only financial issue in your past?

You may be pleasantly surprised to find out what you pay for a Jumbo loan after a short sale may not be that far off from what your rate might be on a conventional and FHA government loans.

USING BANK STATEMENTS FOR A JUMBO LOAN AFTER A SHORT SALE

Another common problem when applying for a jumbo loan can be documenting your income. Self Employed individuals especially run into issues when an lender wants to review their federal tax returns to determine income. Most self employed business owners take as many tax write offs they are legally allowed to in order to avoid paying more taxes…

… this can cause an issue when you are trying to qualify or close a jumbo loan and compound if you have a foreclosure bankruptcy or short sale in your past.

WAYS TO QUALIFY IF YOU CANNOT SHOW ENOUGH INCOME ON A TAX RETURN

-

-

Using the deposits on your personal bank statements to qualify for a mortgage or jumbo loan

FRESH START PROGRAM AFTER A SHORT SALE OR FORECLOSURE

Expanding the boundaries to home ownership, with our Fresh Start Program

For qualified buyers with 20% down, our lending partners. are pleased to offer expanded guidelines and lightened rules to meet a wide variety of home financing needs.

Our Fresh Start program is uniquely designed to serve borrowers who have a short sale, deed –in-lieu, foreclosure or bankruptcy on their record, but are working hard to re-establish their good credit. Fresh Start features and requirements:

- No seasoning or mortgage pay history required after short sale, deed-in-lieu, bankruptcy or foreclosure

- Bank statement option for self-employed borrowers

- Minimum FICO score going as low as 520

FIND OUT WHAT RECENT CLIENTS HAVE SAID BELOW

We can also provide a Jumbo Home Loan up to 90% LTV (only 10% Down Payment) with NO MORTGAGE INSURANCE

If you want your easy fast no obligation quote reach out for a casual conversation and get approved for that Jumbo Home loan even if you’ve had problems in the past due to your past foreclosure, bankruptcy or short sale. We will help you secure a Jumbo mortgage after your short sale foreclosure or bankruptcy.

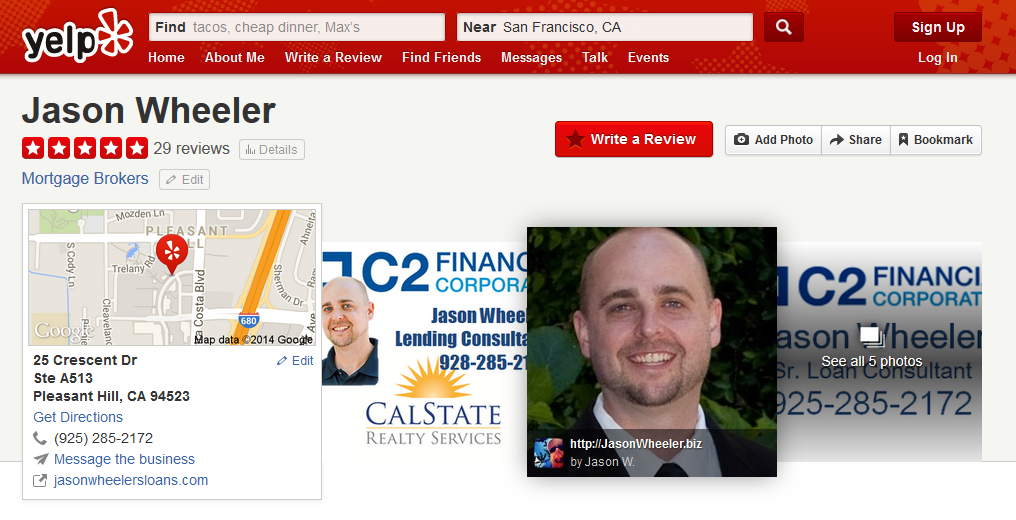

JASON WHEELER

FIND OUT WHAT OTHERS ARE SAYING ABOUT OUR HOME LOAN SERVICES:

FIND OUT WHAT OTHERS ARE SAYING ABOUT OUR HOME LOAN SERVICES:

Can you do loans for houses in Arizona?

Glad you found it helpful Mel. We can help with FHA loans too. The loan after short sale tends to be a bit more expensive than some of the other programs so it is a niche fit for most consumers.

I can’t really quote specific rates on the blog since they are customized to your individual credit profile. These rates tend to be anywhere from 2 to 4% higher than normal conventional rates depending on loan to value ratios and overall credit.

I hope that helps. Give me a call if you have questions.

Yes we can. Do you still need help?

Hi Jason,

Looking for a jumbo loan after a short sale over three years ago. Building a house that will be completed in April/May 2017. Total cost $700,000, putting 20% down, looking to finance $560,000. Credit 670-700. High income with secure job >17yrs. $300,000 annually. Can you help me ?