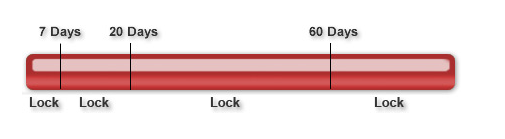

If I were considering financing/refinancing a home, I would…. Lock if my closing was taking place within 7 days… Lock if my closing was taking place between 8 and 20 days… Lock if my closing was taking place between 21 and 60 days… Lock if my closing was taking place over 60 days from now… This is only my opinion of what I would do if I were financing a home. It is only an opinion and cannot be guaranteed to be in the best interest of all/any other borrowers.

Friday’s bond market has opened well in negative territory following some surprising economic news. The stock markets are showing gains, but they are relatively minor considering the importance of this morning’s data. The Dow is currently up 55 points while the Nasdaq has gained 9 points. The bond market is currently down 22/32 (2.31%), which should push this morning’s mortgage rates higher by approximately .250 – .375 of a discount point.

Today’s big news was November’s Employment report from the Labor Department at 8:30 AM ET. It revealed that the unemployment rate remained at 5.8% as it was expected to do. The huge surprise came in the new payroll number that showed 321,000 new jobs were added to the economy last month, greatly exceeding forecasts of 229,000. That was the largest monthly increase in almost three years. There were also upward revisions to October and September that added 44,000 jobs to the previously announced totals. Furthermore, the hourly average earnings reading showed a 0.4% rise in income that was twice what was expected and raises concerns about wage inflation. These numbers clearly make the data overwhelmingly negative for the bond and mortgage markets.

The Commerce Department gave us today’s second piece of data at 10:00 AM ET. They announced that October’s Factory Orders fell 0.7%. That is a bit of good news for bonds because analysts were expecting to see a small increase in new orders. Unfortunately, the employment data is much more important to the markets than this report and is the driving force in today’s bond selling and increase in rates.

Next week does have a couple of important economic reports scheduled in addition to two Treasury auctions that are likely to affect bond trading. All of the relevant data and events are scheduled for the latter half of the week. With nothing of importance set for release Monday, we can expect weekend news and possibly a carryover from this afternoon’s tone in trading to be the biggest influence on mortgage rates as the week opens. Look for details on the week’s activities in Sunday evening’s weekly preview.

JASON WHEELER

925-285-2172

Leave Me a Quick Comment or Note