AMAZING VALUE WITH THIS DEBT REDUCTION SNOWBALL or AVALANCHE CALCULATOR

I use this custom debt reduction calculator personally. It comes as an easy to use Excel spreadsheet, and you can download it for free by clicking the link below.

I originally found this spreadsheet on the everything Excel template site vertex42. They’ve got some great templates over there that are well worth a look, be sure to follow them at @vertex42

WATCH MY VIDEO TRAINING ON HOW TO USE THIS HERE

Some of the things this calculator does are:

-

Create a plan for debt payoff

-

Set up an easy to follow payment schedule

-

Gives you different plan options given your financial situation

-

Explains everything very clearly in easy steps

———————————————–

DOWNLOAD YOUR DEBT REDUCTION CALCULATOR HERE

———————————————–

Using this sheet will help you accelerate your debt payoff much faster and calculate an easy to follow plan.

FAST DEBT REDUCTION: USING THE SNOWBALL METHOD

The debt-snowball method is a debt reduction strategy, whereby one who owes on more than one account pays off the accounts starting with the smallest balances first while paying the minimum on larger debts.

Once the smallest debt is paid off, one proceeds to the next slightly larger small debt above that, so on and so forth, gradually proceeding to the larger ones later.

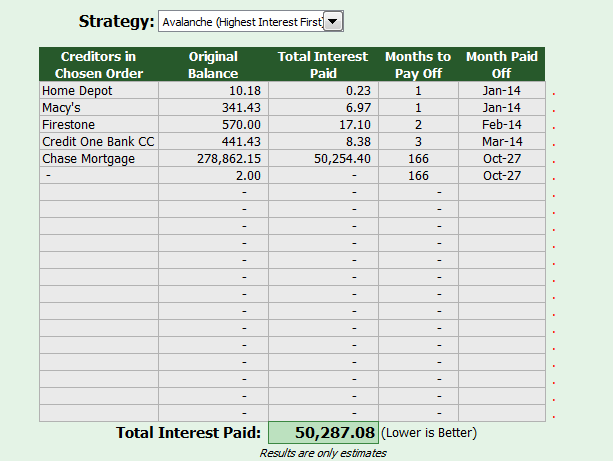

FAST DEBT REDUCTION: USING THE DEBT AVALANCHE METHOD

The Avalanche: This method requires a bit more math. It’s basically the opposite of snowballing, except you’re not paying off your largest balance, but rather your most expensive balance, or the balances with the highest interest rate.

So, say you have three credit card balances: $500 with an annual percentage rate of 10%, $2,000 with an APR of 20%, and $5,000 with an APR of 15%, you’d pay off the credit card with an APR of 20% first, because that’s the one that will cost you the most over the long run due to compound interest.

Once you eliminate the balance with the highest interest rate, you’d move on to the balance with the next highest interest rate (the $5,000 balance with the 15% APR), until all your balances are paid off.

Here is a good article to compare the two methods to see what is best for you… The Avalanche Method or the Snowball Method.

Well I hope that this free download and debt reduction spreadsheet will help you reduce your debts faster and save you money.

If you found this helpful please share this article.

Jason Wheeler

This is awesome! I went on YouTube to find a payment schedule and this was so simple! I truly believe I can now follow this plan, add extra to it at times for payments, and get out of debt!!! Thank you!

Glad you appreciated it Katie! If I can help you in any way just let me know. Thanks.

I just downloaded the debt reduction calculator and plugged in my figures. It was easier than I thought! Thanks so much. I can’t wait to pay down my debt as quickly as I can.

OK, I RARELY post comments on-line, but Wow! This is Awesome. I can’t put into words the relief I felt after running our numbers. What seemed like a lifetime of debt, paying off a huge student loan, our primary residence, and 3 rental properties, now seems so doable. We can do it in 7-10 years. Wow, Wow, Wow.. Thank you.

For so long I thought I could keep it all together, I felt like I was drowning. Your program gave me the ability to see the light at the end of the tunnel. I will be out of debt in 17 months!! Thank you!!

It makes me so happy that you left me this note Angie. Thank you for saying hello and letting me know it helped you. If you know anyone that is deep in debt please feel free to share the program with them personally or on social media. Since the information is all free anyone can benefit from it who is having debt troubles.

Thank you!

Hi Melissa,

I just came across this comment and it truly made my day! Thank you for saying hello. I’m glad I could help you.

Glad to be able to help you Denise. Please share it with your friends if you could. Thank you.

Not able to open calculator sheet I had to close because it was not working

My car payments are set up to be bi-weekly. Is there a way to change the debt calculator to reflect this?