Jumbo mortgage loans for Walnut Creek CA homes can be hard to get approved for if you aren’t working with a Loan Officer or Mortgage Broker that knows exactly how to structure your loan.

Most consumers applying for these large Jumbo Loans in the Walnut Creek area have complicated tax returns with K-1s and many other schedules that may be difficult for many underwriters and loan officers to understand.

This is why it is important to be sure you are working with one of the best bay area Mortgage Brokers you can find when it comes to applying for a Jumbo Loan.

Jumbo Mortgage Loan Applications are Making a Comeback in Walnut Creek and Surrounding Cities

According to Mercury News:

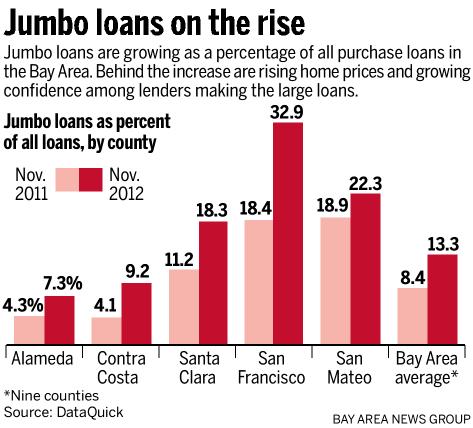

The jumbo loan is making a comeback, a welcome trend for Bay Area home buyers and one more sign the housing market is reviving.

Jumbos — home-purchase loans above $625,500 in the Bay Area — are vital for this high-priced region, but had all but disappeared during the credit crunch as eroding home values scared lenders off.

Now the rebound in home prices has given lenders more confidence about making these loans. At the same time, the spread between the interest rates for jumbos and the rates for smaller loans has narrowed, making them a less costly option for home buyers.

“It’s getting back to normal,” said Andrew Soss of Stewart & Soss Mortgage in San Jose. “We’ve seen a pretty big increase in requests for jumbo loans”

Bay Area Jumbo Loan Applications on the Rise.

What is the best time for the best jumbo mortgage rates?

Rates are a commodity and they change as rapidly as the stock market or gas prices. The best thing to do to find the best rate on a jumbo mortgage loan in Walnut Creek, Orinda or Lafayette is to talk to a seasoned Bay Area Mortgage Broker you feel like you trust.

Walnut Creek Jumbo Portfolio Loans: What’s the Difference

“What is a Jumbo Mortgage?”

Jumbo mortgages are large, private loans that aren’t guaranteed by government agencies such as Fannie Mae, Freddie Mac, and the Federal Housing Administration because they exceed federal loan limits.

Guaranteed loans are capped at $417,000 across much of the country, although in higher-priced regions such as the Bay Area the maximum loan amount limits are higher.

Fannie Mae and Freddie Mac guarantee mortgages up to $625,000 in San Francisco, Alameda, Contra Costa, and Marin counties, and up to $592,250 in Napa County and $520,950 in Sonoma County. FHA loans have higher limits: $729,750 in San Francisco, Alameda, Contra Costa, Marin, and Napa counties, and $662,500 in Sonoma County.

Jumbo mortgages have higher interest rates than so-called conforming loans because issuing banks assume more risk without federal loan guarantees.

But the difference between conforming and jumbo loans is shrinking, making jumbo loans more attractive.

Jumbo Loans in Walnut Creek: How do I Easily Apply for One?

You should get in touch with a local Bay Area Mortgage Broker that works with several different lenders.

Get a referral from a friend you know who just did a refinance.

Or ask a local Realtor you know if they can recommend a great lender in your local area.

Whatever you do…

When you interview and speak with a Mortgage Broker about a Jumbo Loan. Make sure you follow our gut first.

– Jason Wheeler

PS: We work with private portfolio and jumbo mortgage lenders all over the SF Bay Area. We focus our business in East Bay cities like Walnut Creek, Orinda, Lafayette and Pleasant Hill. Get in touch today with an email if you ever have a question you need an answer to.

PPS: If you don’t have an income we also offer “Asset Based Lending”

Leave Me a Quick Comment or Note