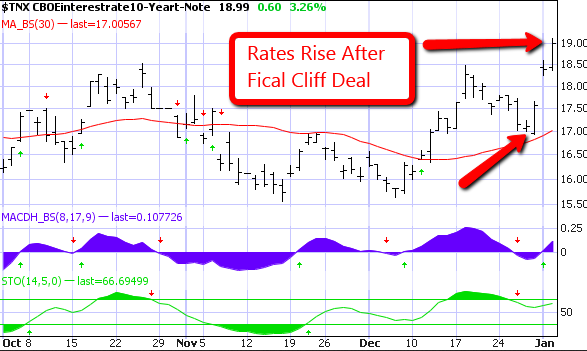

Current mortgage rates in the SF Bay Area sky rocket in the New Year after “Fiscal Cliff” deal gets pushed through in Congress.

It’s very difficult to gauge the long term direction of the market place but over the last few years I’ve gotten really good at predicating “short term mortgage rate trends”

I have quite a few happy clients as I convinced most of them to lock in their mortgage rates during the last few days of 2012.

Needless to say most of them are quite happy after seeing the most recent trend shift

Bay Area Mortgage Rate Chart – Rates Skyrocket Amidst Fiscal Cliff Deal in 2013

Check out this most recent trend chart showing three days of major volatility.

If you are not sure how to read today mortgage rate trend chart…

I’ve made a video training anyone can use to learn how to gauge the mortgage market and predict short term mortgage rates. In this video I also demonstrate my ability to beat my stiffest competition on mortgage pricing.

Watch The Training Video here.

Will Bay Area Mortgage Rates Shift Downward Again in the Near Future?

With the current volatility in the market and a lot of unrest in the financial sectors and in the new Congress it is very hard to say exactly what will happen to short term mortgage rates.

This Bay Area Mortgage Broker’s educated guess is that in the short term we will see rates continue to trend upwards. In the past day the ten year note really broke through a key resistance level on an upward trend.

Unless something drastic changes with the most recent laws put into place this Mortgage Broker says we may have seen a short term bottom in mortgage rates turning the last quarter of 2012.

If you are on the fence about a refinance you may want to apply NOW before you loose even more pricing ground.

Lack of inventory and high competition in the CA Bay Area continue to push home prices upwards as well.

Protect Yourself From Losses and Lock in Your Mortgage Rates Today!

Yeah Yeah Yeah… Everyone always says that right?

… Lock in your rate or else.

… They are super low or else.

I’m saying if you locked in the past few weeks you likely made out like a bandit and hit rock bottom. You probably want to lock them in now and protect against future losses.

– Jason Wheeler

PS: Do you have a question about Portfolio Private Lending or mortgage rates in the Bay Area? Connect with me online here and ask me about it?

Leave Me a Quick Comment or Note