Posted by Jason Wheeler | Fully Follow Me | Subscribe

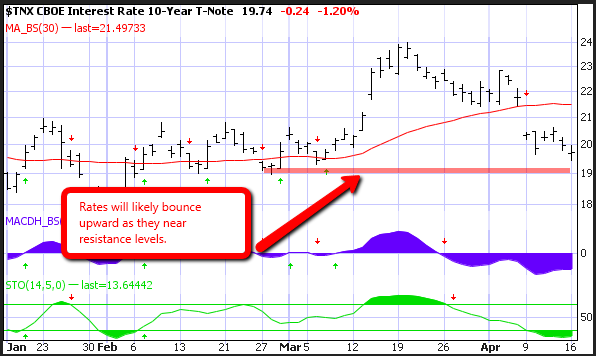

Mortgage rates continue to decline from last week. Current pricing is now at it’s lowest since February. Recommendation is to lock in if you are processing a mortgage and you are looking to close this month.

——————————————————–

After closing out the previous week with slight gains Mortgages Rates have done the same to begin the current week. On average, this brings rates to their best levels since late February, however, rates were in similar territory on Tuesday 4/10. The late February levels in question contained all time mortgage rate lows.

Any time we talk about “lows” or “best levels,” it’s important to keep in mind that we’re constantly assessing BOTH the interest rates AND the costs associated with them. In actuality, the interest rate you’d be quoted today may very well not be different from what you would have been quoted on Friday, although the lender’s costs are likely somewhat lower.

The consideration of both RATES and COSTS is central to our determination of a “Best-Execution” rate, which can generally be thought of as the most efficient combination of payment vs. costs. Today, the Best-Execution rate for 30yr Fixed Conventional Loans remains at 4.0% for many scenarios and is increasingly available at 3.875% for some scenarios.

As you can see we get Jumbo Loans DONE when other lenders can’t do it. We mainly do this in cities across the California SF Bay Area like, Orinda, Lafayette, Pleasant Hill, Alamo, Blackhawk, San Ramon, Walnut Creek, San Francisco and Oakland CA.

Leave Me a Quick Comment or Note